If you own a property in France, whether you are a French resident or a non-resident, whether the property serves as a primary residence, secondary home, or a rental, you are subject to property tax. This blog will explore various aspects of property tax, from the average amount to the reasons for its rise and possible exemptions.

Definition of property tax

The property tax (“taxe foncière”) is a local tax collected annually by French local authorities. The property tax applies to built-up properties (TFPB - “taxe foncière sur les propriétés bâties”), including houses, apartments, parking lots, outbuildings (such as garages, cellars, gardens, etc.), and boats used as fixed points.

The Taxe Fonciere also applies as a “land tax;” the owner must pay it even if no buildings exist on the land. That is why there is property tax on non-built properties (TFPBN - “taxe foncière sur les propriétés non bâties”). The non-built properties subject to property tax include farmland, undeveloped golf courses, ponds, etc.

The property tax is often levied with other taxes, such as taxes on household waste (TEOM).

Who pays property tax?

Owners or usufructors of a property on January 1, whether occupied or not, must pay property tax.

How to calculate property tax?

The property tax is calculated based on cadastral rental value and the tax rates set by local authorities.

Tax base for property tax on built-up properties

The tax base for property tax on built-up properties is equal to 50% of the cadastral rental value. The cadastral rental value is the theoretical annual rent the owner could earn if renting the property. This cadastral rental value is regularly updated and adjusted, incorporating a flat-rate coefficient determined by considering the harmonized consumer price index (HICP) published by INSEE before taxation.

It is important to note that if changes are made to your property during the year, such as renovations that increase the apartment's value, the cadastral rental value will increase.

Property tax rate for property tax

Each regional or local authority decides and adjusts the property tax rate yearly.

What is the average property tax in France?

According to the DGFiP, in 2022, the average property tax in France was 895 euros.

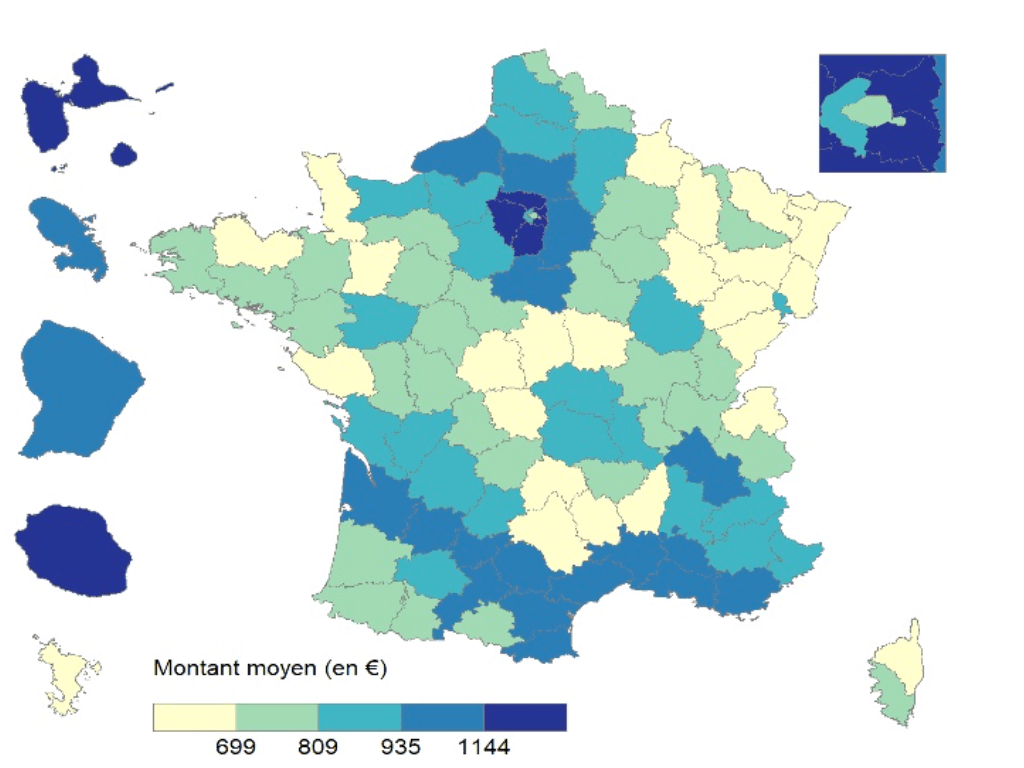

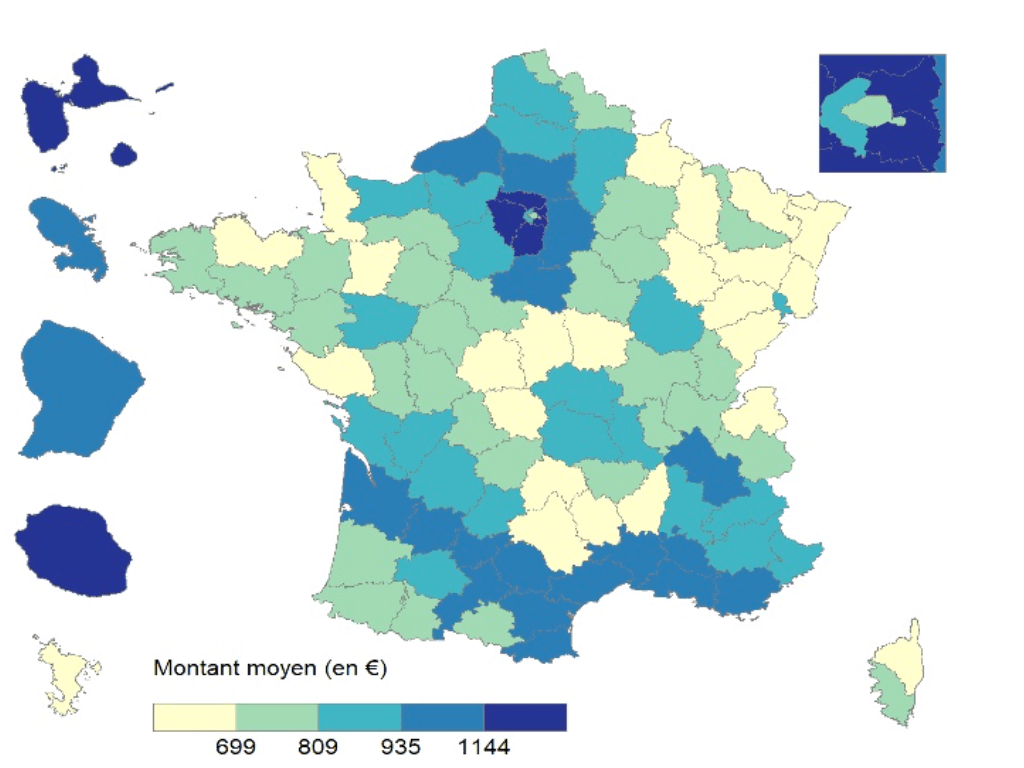

Does property tax vary by location? Yes. According to the DGFiP study, the overseas territories and the Paris region are the areas where France's average property tax is highest. You can see from the graphic below that the bluer the area is, the higher the property tax is in the region.

Average property tax amount per dwelling in 2021, by department, in euros. Source DGFiP

Why has property tax increased in 2023?

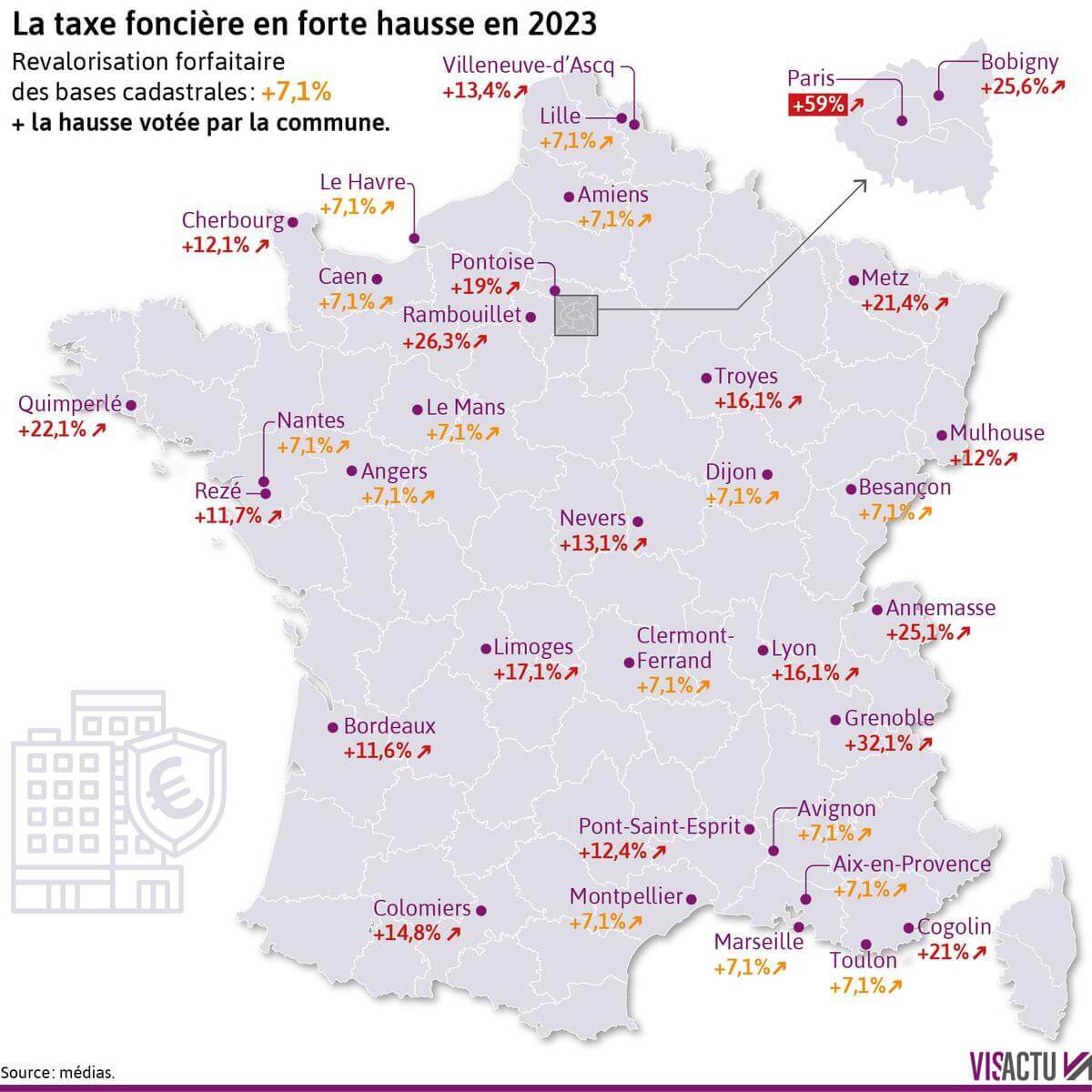

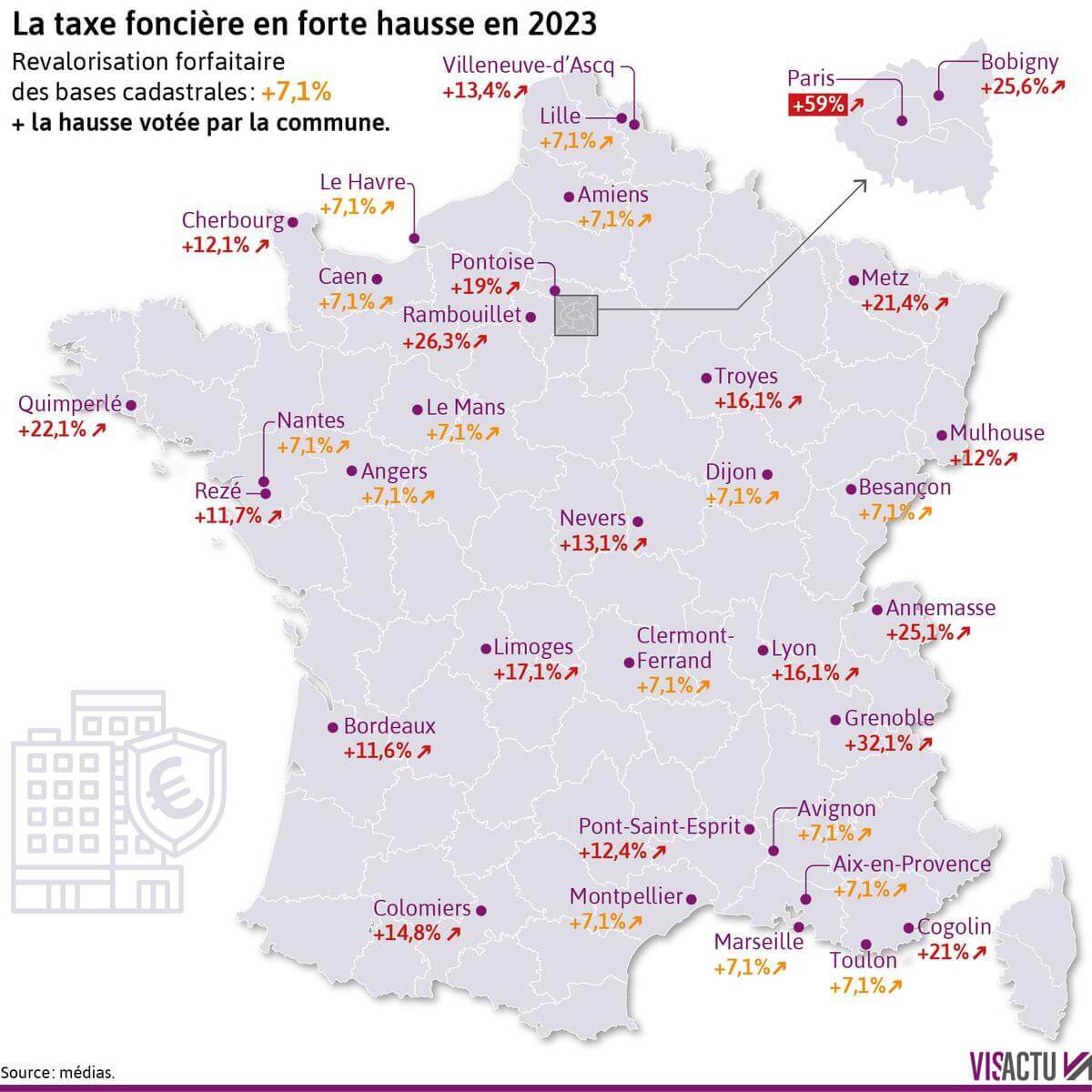

Over the past ten years, between 2012 and 2022, property owners in France have paid an average of 26.3% more in property tax.

Between 2022 and 2023, property tax rates rose by an average of 9.3% in France's major cities!

The significant increase in property tax is mainly due to a rise in the cadastral rental values used to calculate property tax. The property tax rate set annually by French local authorities has also been increased in some communes through a surtax to support expenditures such as the TGV high-speed train, flood prevention, etc.).

Moreover, the general public believes that the increase in property tax is related to the permanent abolition of the housing tax on principal residences.

What are the possible exemptions and reductions for the property tax?

Types of properties exempted from property tax

1) Newly built properties

Newly constructed properties are exempt from property tax for two years following completion. The homeowner has 90 days from completion of the work to file a model H1 tax return (form 6650) with the relevant tax department (CDIF or SIP). In this case, the property tax exemption period starts the year following completion of the work.

2) Vacant rental property

Suppose the owner has a rental property vacant for over three consecutive months due to circumstances beyond their control, such as a disaster or a stagnant market. The owner may qualify for a partial property tax rebate in that case.

To be eligible for the property tax exemption, the owner must submit an occupancy declaration to the tax authorities and all relevant supporting documents, such as a rental mandate with the Real Estate agency. If the claim is accepted, the tax office will reimburse the owner the portion of the property tax corresponding to the vacancy period.

3) Old housing unit carrying out energy renovation<

Owners can benefit from a property tax exemption by conducting energy renovations on an old property in a municipality that has introduced a tax exemption for energy-efficient properties, such as Paris and Nantes. This exemption, applicable in nearly 500 French towns and cities, targets those investing at least €10,000 in energy renovations for dwellings built before 1989.

According to Effy's calculations, this exemption would result in an average savings of €1,275 in France.

To qualify, owners must submit a declaration and invoices upon completing the work. The exemption is valid for three years from the year following the payment for the energy renovation.

Individuals exempted from property tax

1) Low-income seniors

Some low-income seniors are fully exempt from property tax. The following conditions must be met to benefit from the property tax exemption :

- Be over the age of 75

- Income from the previous year must not exceed a definite amount (for the property tax 2023, your reference tax income in 2022 should not exceed €11,885 as a single person, or €18,233 if you are married or in a PACS)

2) People receive one of the following allowances

Regardless of age, the owner is automatically exempt from property tax on their principal residence (and only that) if they receive solidarity allowance for older people (Aspa), additional disability allowance (Asi), or allowance for disabled adults (AAH).

Individuals eligible for possible reductions on their property tax

Suppose an individual is over 65 but less than 75 years old, and their reference tax income (RFR) is below the income limits set in the French General Tax Code. For example, in 2023, their 2022 reference tax income can be no higher than €27,947 (if single) or €39,617 (if married or in a civil partnership). In that case, the person may be eligible for:

Individuals living in retirement homes are also eligible for this property tax reduction if their primary residence remains unoccupied.

How to pay property tax?

Payment of property tax of more than 300€

For a property tax of more than 300€, the taxpayer must pay their property tax online or by direct debit.

Payment of property tax of less than 300€

For a property tax of less than 300€, the owner can pay in the following payment methods:

You can pay your property tax directly online via computer at this link on a smartphone or tablet by downloading the "Impots.gouv" application.

Direct debit is made automatically ten (10) days after the payment deadline shown on the tax notice.

The taxpayer must have a bank or Livret A savings account domiciled in France or Monaco that allows direct debit. You can sign up for direct debit online or at your local tax office.

You can pay your property tax by monthly direct debit if you have a bank account or a Livret A savings account domiciled in France or Monaco. You must sign up for direct debit (online or through your tax office) to be eligible.

- By cheque

- Interbank payment orders (TIP Sepa)

- By bank transfer

You need to give your bank a transfer order for the property tax payment, indicating your bank details and the nature and due date of the tax.

- In cash at a partner tobacconist.

- By credit card at a partner tobacconist.

FAQ for Property Tax

1. Is it normal to receive a property tax notice for a vacant or unoccupied house?

Yes, property tax on built-up properties must be paid by the owner whether the premises are occupied or vacant. Unfortunately, following decree no. 2023-822 of August 25, 2023, in many communes, the owner must pay both the property tax and the vacant housing taxes in both tense and non-tense zones.

However, property taxpayers may benefit from a reduction in the property tax on their built-up properties (article 1389 of the CGI) in some circumstances if the vacant property was initially intended for rental or if the vacant property was for commercial or industrial purposes.

2. Can owners make their tenants pay property tax?

No! The owner pays property tax even if the property is rented out. Regardless of the type of lease signed, it is impossible, even illegal, for a landlord to require their tenant to pay property tax.

Nevertheless, landlords can seek reimbursement from their tenants for the household waste collection tax (TEOM), which is levied in the property tax.

3. Who pays the property tax when you sell the property?

Property tax is charged for the whole year, depending on its situation, on January 1 of the tax year. Therefore, if the person owns the property on January 1, they are liable for the entire year's property tax, even if they sell the property during the year. However, an agreement can be made between the seller and the buyer to share the property tax payment on a pro-rata basis.

In conclusion, in the landscape of property tax, property owners should stay informed about changes in cadastral rental values, tax rates, surtaxes & special taxes, and potential exemptions to make decisions and manage their financial responsibilities cautiously.

Editor: Siyi CHEN

Sources: Service Public, UNPI, Moneyvos

Français

Français