So you thought the council tax (taxe d'habitation) was over? Unfortunately, owners of second homes and rented properties still have to pay the council tax.

Anyone who owns a property in France, whether a primary residence or a second residence, must file an additional tax form following changes to the tax system.

Why would this be good news for the future?

Following the French government's decision to abolish the housing tax for residents of principal residences, the tax authorities need to update property owners' information on the occupancy status of their properties to apply the correct tax regime. If you own a property in France, you must know the new property tax declaration obligations. This new declaration applies to all property owners, individuals, companies, or non-trading property companies (SCI).

Who is concerned by this property declaration in France?

This property occupation declaration applies to local French residents and foreign non-residents, whether or not they are French nationals. It also applies equally to undivided co-owners and usufructuaries.

All in all, the property declaration in France applies to :

- individuals

- legal entities (SCI, social landlord, etc.)

- owner-occupiers

- landlords

- owners living in France

- owners living abroad who own property in France

However, if you were not yet the property owner by January 1, 2024, it is up to the former owner to declare occupancy.

Another new feature for 2024: after submitting their online tax declaration, taxpayers who own property and have filed online declaration are automatically redirected to the online occupancy & rent declaration service.

According to the figures the French tax authority (DGFiP) communicated, 34 million property owners are concerned, covering 71.4 million premises.

What is the deadline for your property declaration to the tax authorities?

If the occupation status of one of your properties changes between January 2, 2023, and January 1, 2024, you must declare it before July 1, 2024.

Nota Bene: this Real Estate declaration is a separate process from the standard income tax declaration. You must, therefore, ensure that you fulfill this additional declaration obligation, even if you have already filed your income tax return.

Face à ce changement, le fisc français a décidé de faire preuve de bonne bienveillance envers les retardataires de bonne foi. En 2023, aucune pénalité n'était appliquée en cas de défaut de déclaration, d'erreur, d'omission ou de déclaration incomplète. En revanche, à partir de 2024, des pénalités s'appliqueront après l'envoi de relances aux propriétaires qui n'ont pas respecté les délais.

What is the occupancy declaration for residential premises in France?

Since the property declaration mainly consists of an occupancy declaration, it is also commonly called an occupancy declaration for residential premises. The occupancy declaration asks the property

owners to clarify whether their property is occupied or rented and by whom: the owner themselves, tenants, or even guests for free, and to fill in the identity of the occupants and the period concerned.

Where to fill the property occupancy declaration?

To fill your property occupancy declaration, go to impôts.gouv.fr, then "Votre espace particulier", then click "Biens immobiliers", and "Déclaration d’occupation".

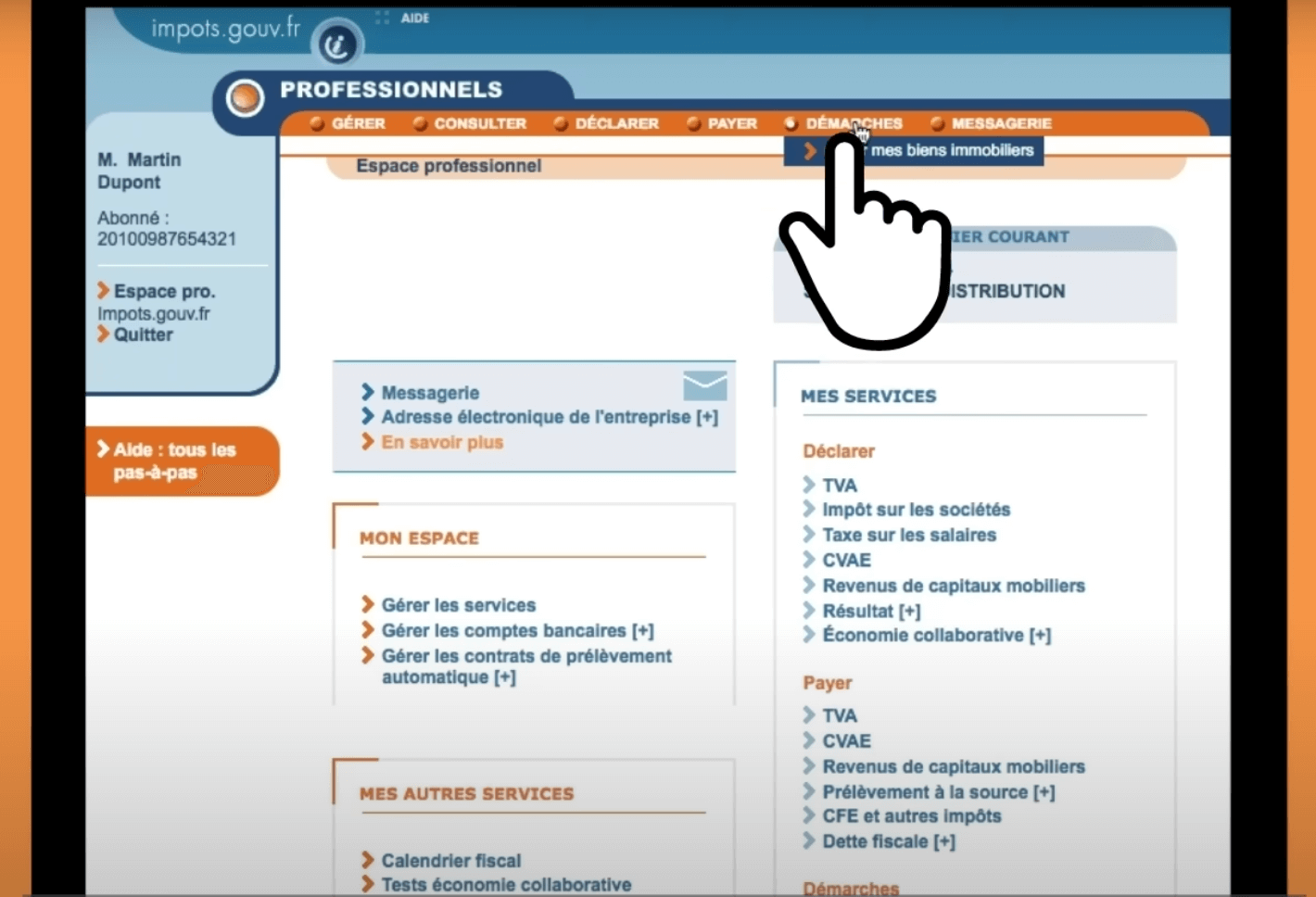

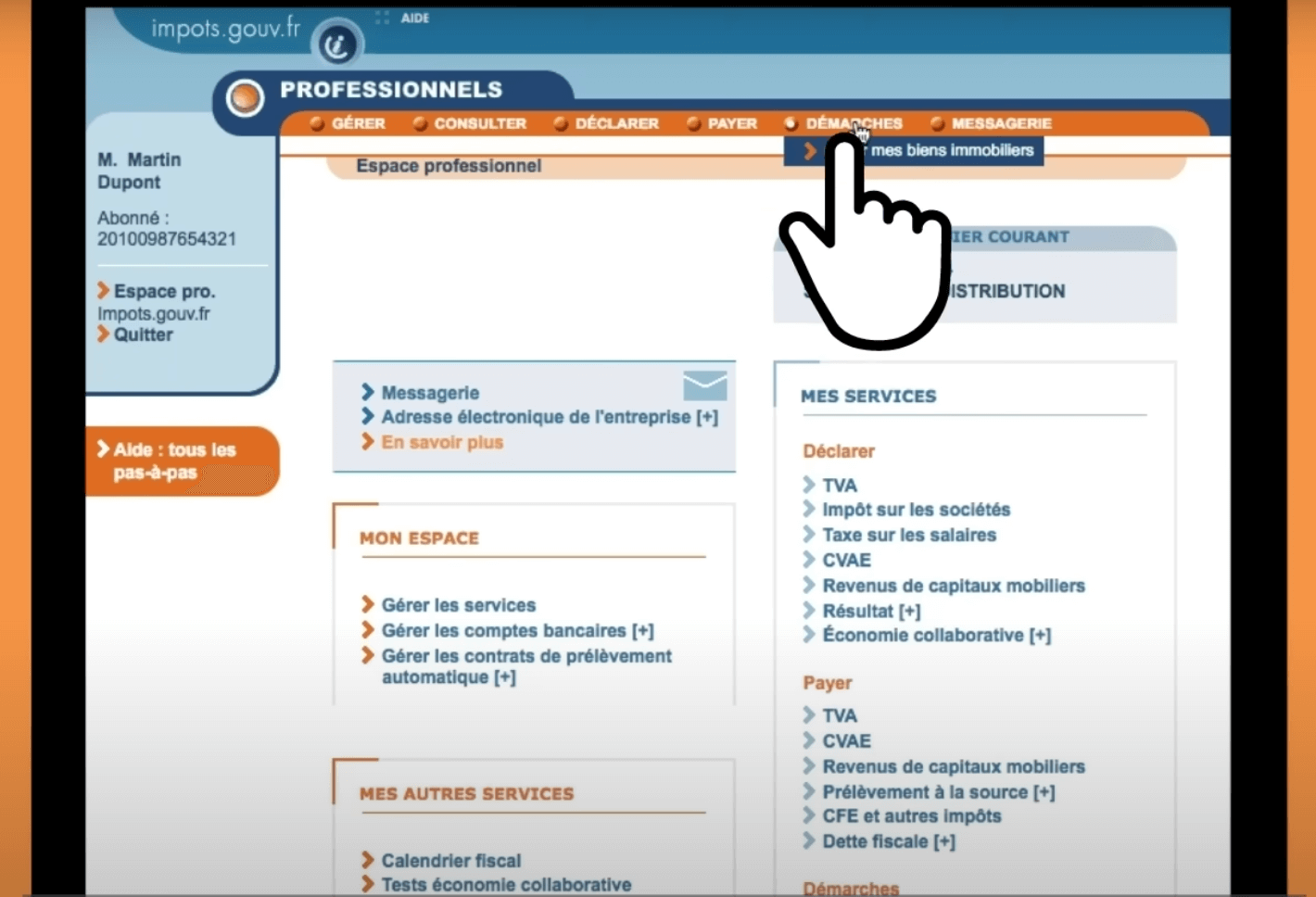

For professionals, go to "démarches", then click on "Gérer mes biens immobiliers".

The information previously submitted to the tax authorities will be pre-filled. Review and complete the declaration form indicating the occupancy status and the name(s) of the occupant(s) or tenant(s).

This declaration service collects the rent information for rented residential premises from landlords as part of the revision of rental values.

Helpline for homeowners and foreigners for the Real estate declaration?

To help some foreign owners understand this new tax obligation, especially for those who don't have an account with "impôts.gouv.fr", the French government has set up a hotline.

This dedicated helpline will help French property owners complete their Real Estate declaration on 0809401 401. This service is available from Monday to Friday, 8:30 a.m. to 7:00 p.m.

Why should you file a declaration of occupancy in France?

This property occupancy declaration aims to provide the French tax authorities with precise information on residential premises so everyone will be correctly taxed before the tax notices are issued.

The Real Estate occupancy declaration will allow the adjustment of the tax revenues for local authorities. Moreover, the Ministry of Finances has an upcoming revision of rental values in store

How to declare a new rental in France?

To declare a new rental (from a principal residence, secondary residence, or vacant dwelling), you must complete the following declaration procedure:

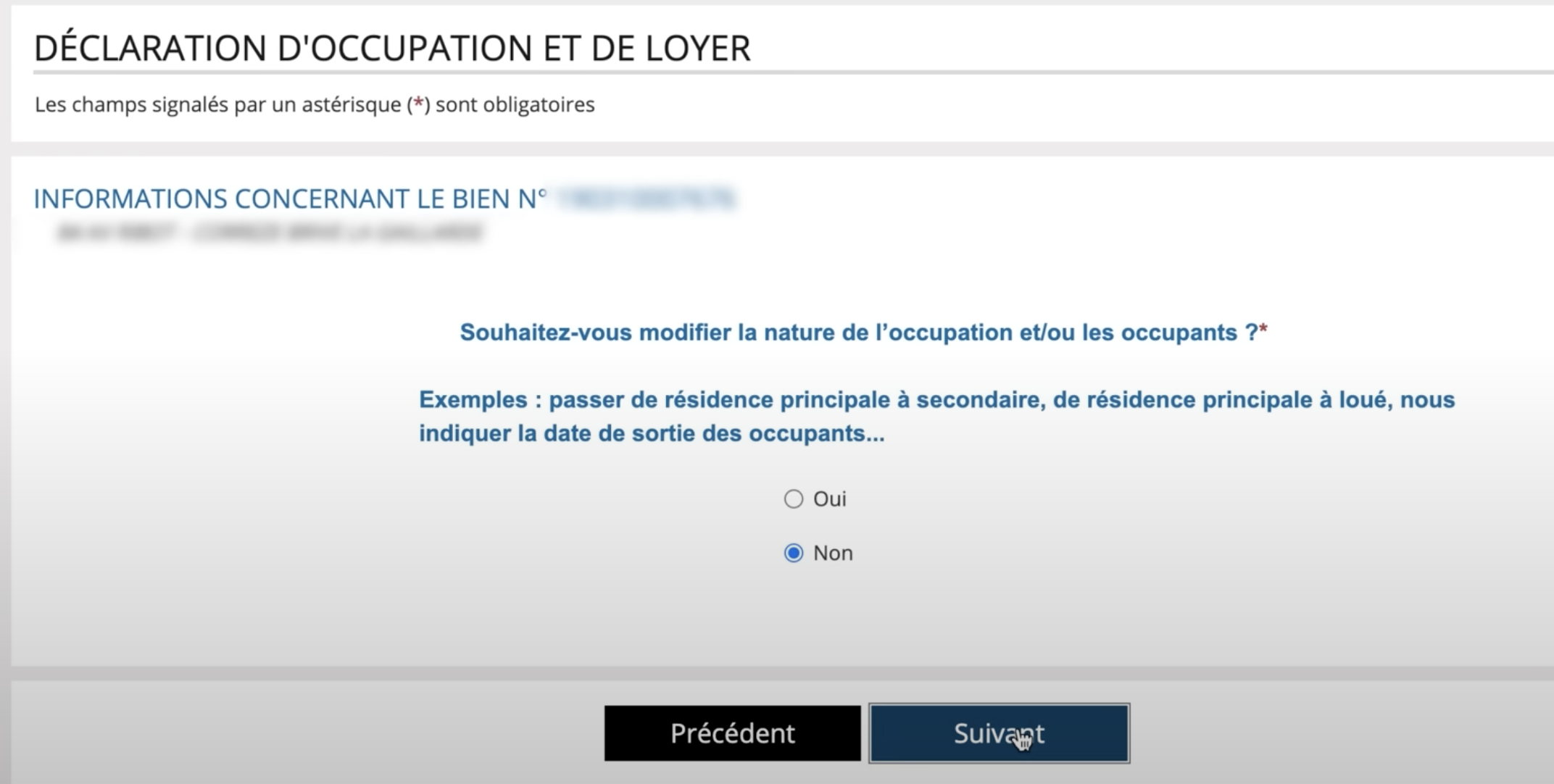

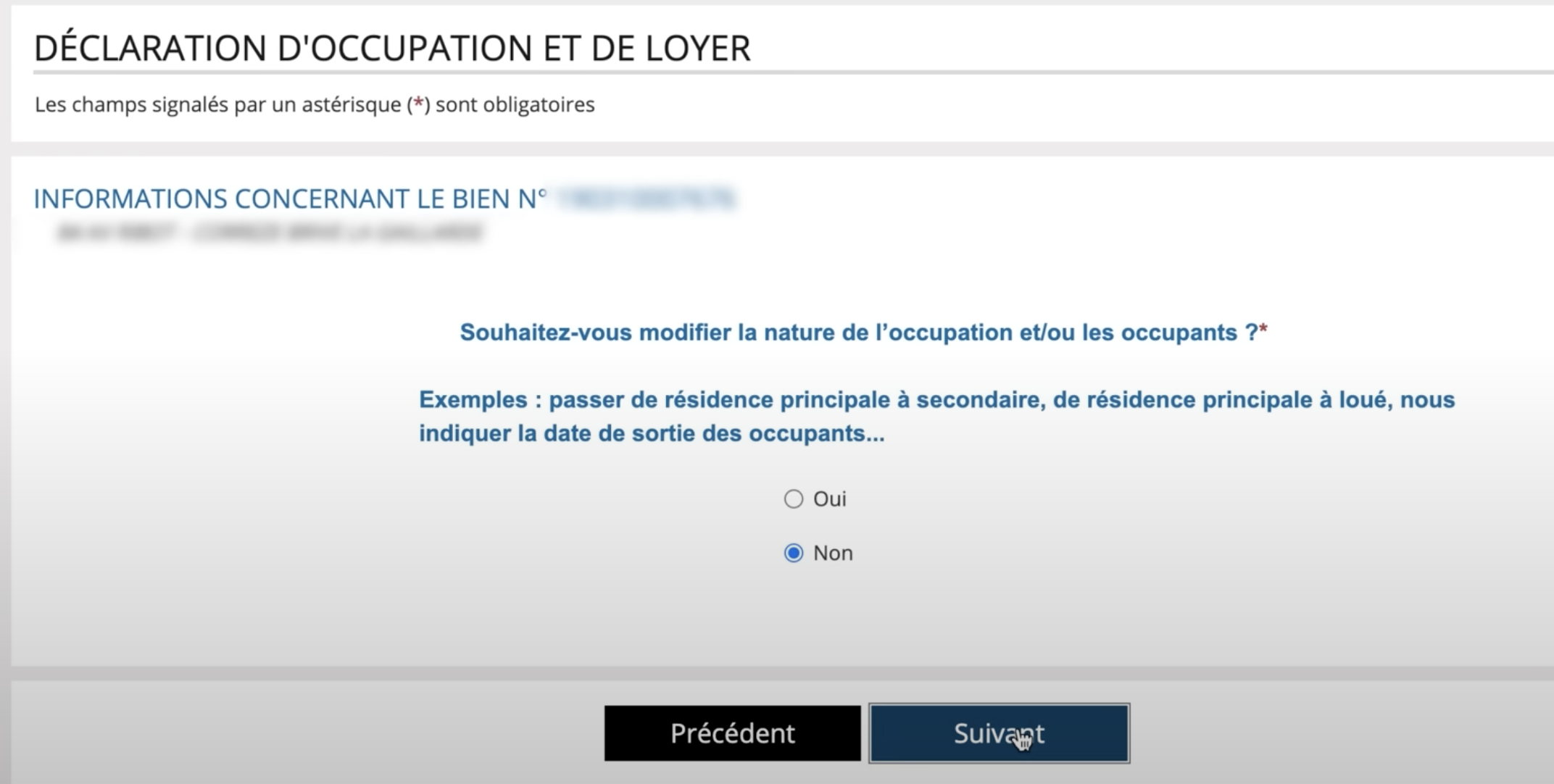

1- Answer "YES" to the question, "Do you wish to change the nature of occupancy for your dwellings, or are its occupants new"?

Click on the "following" button

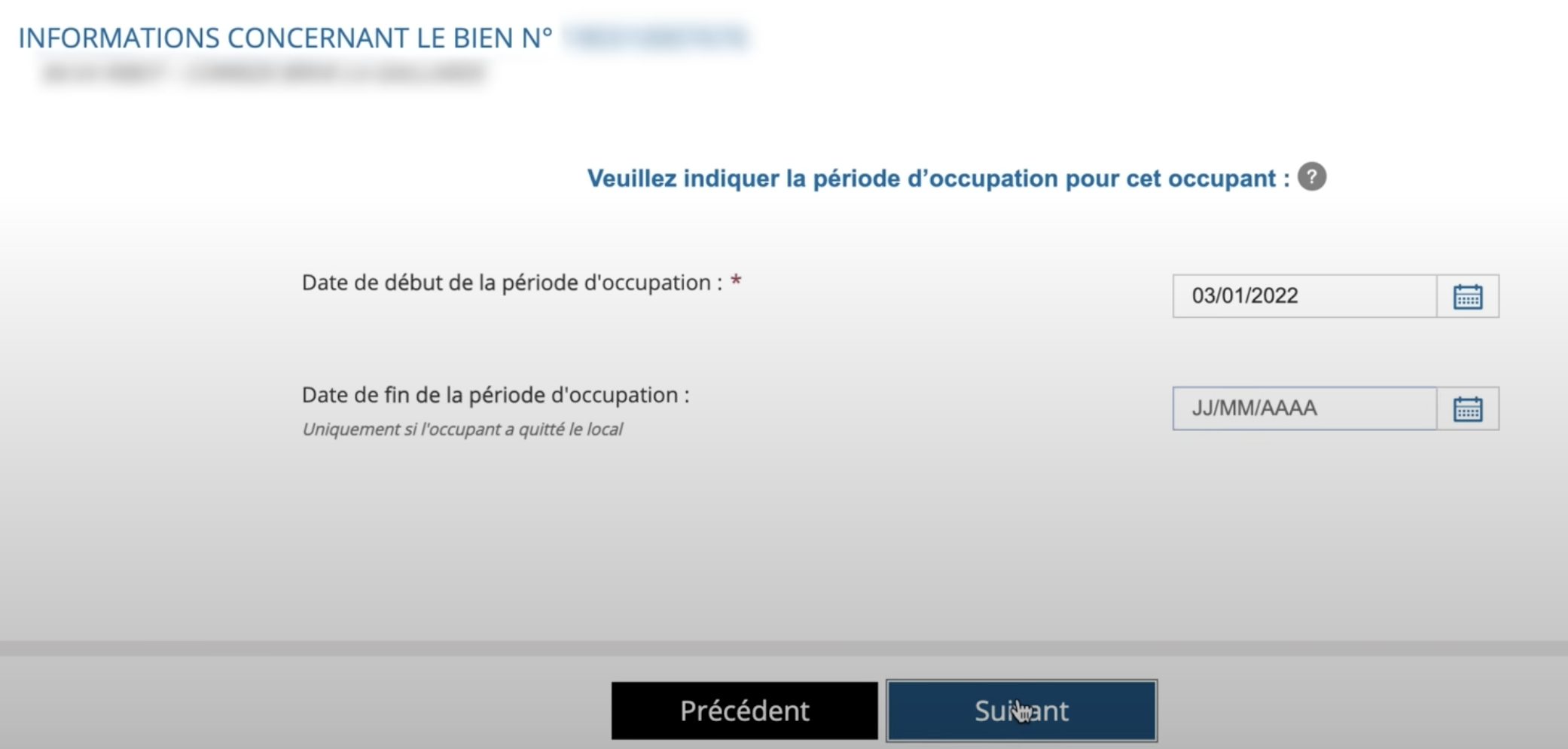

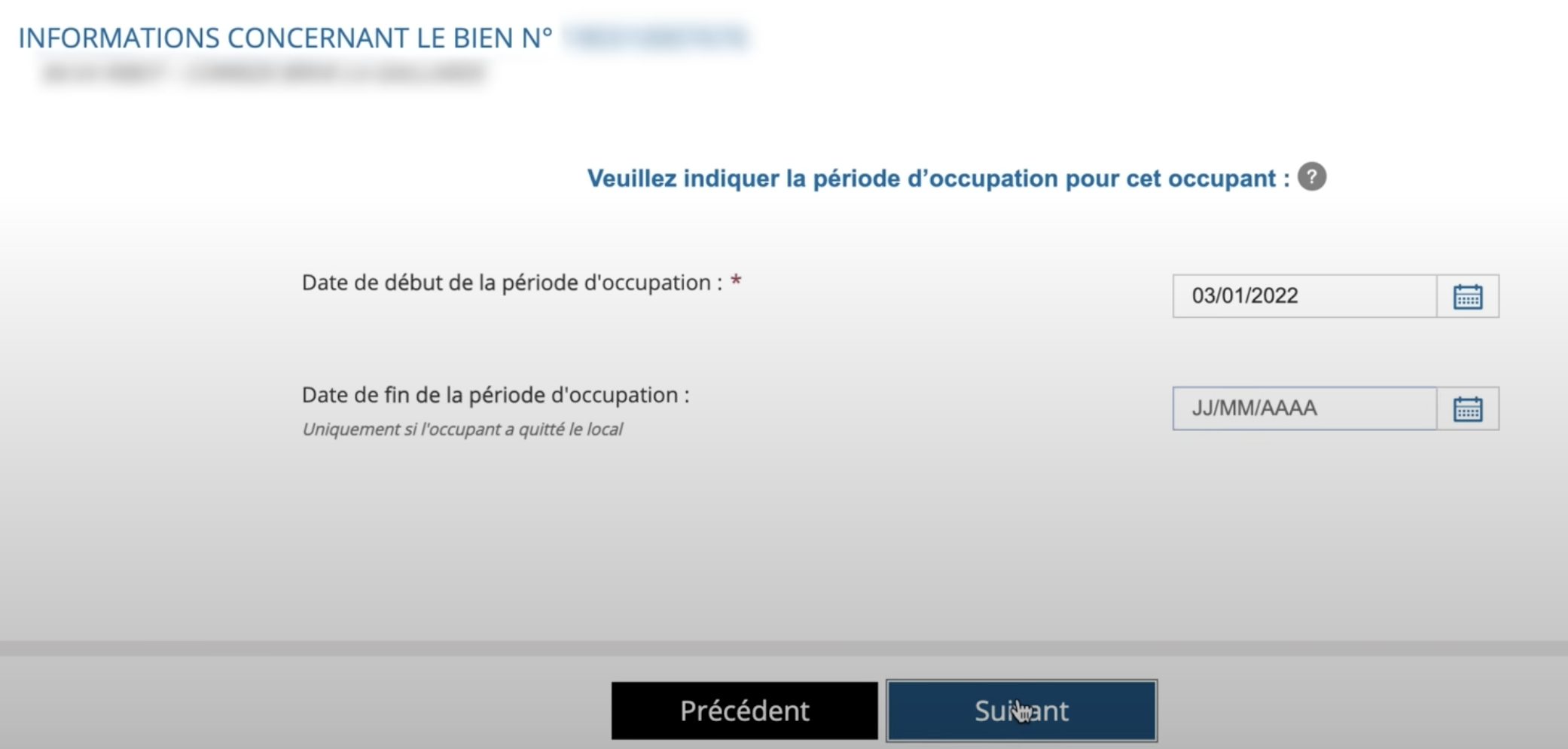

2- On the next page, indicate the end date of the previous occupancy by entering the date on which the tenant entered the property, then click on the "next" button.

3- Click on "Please specify occupancy" and click on the next button.

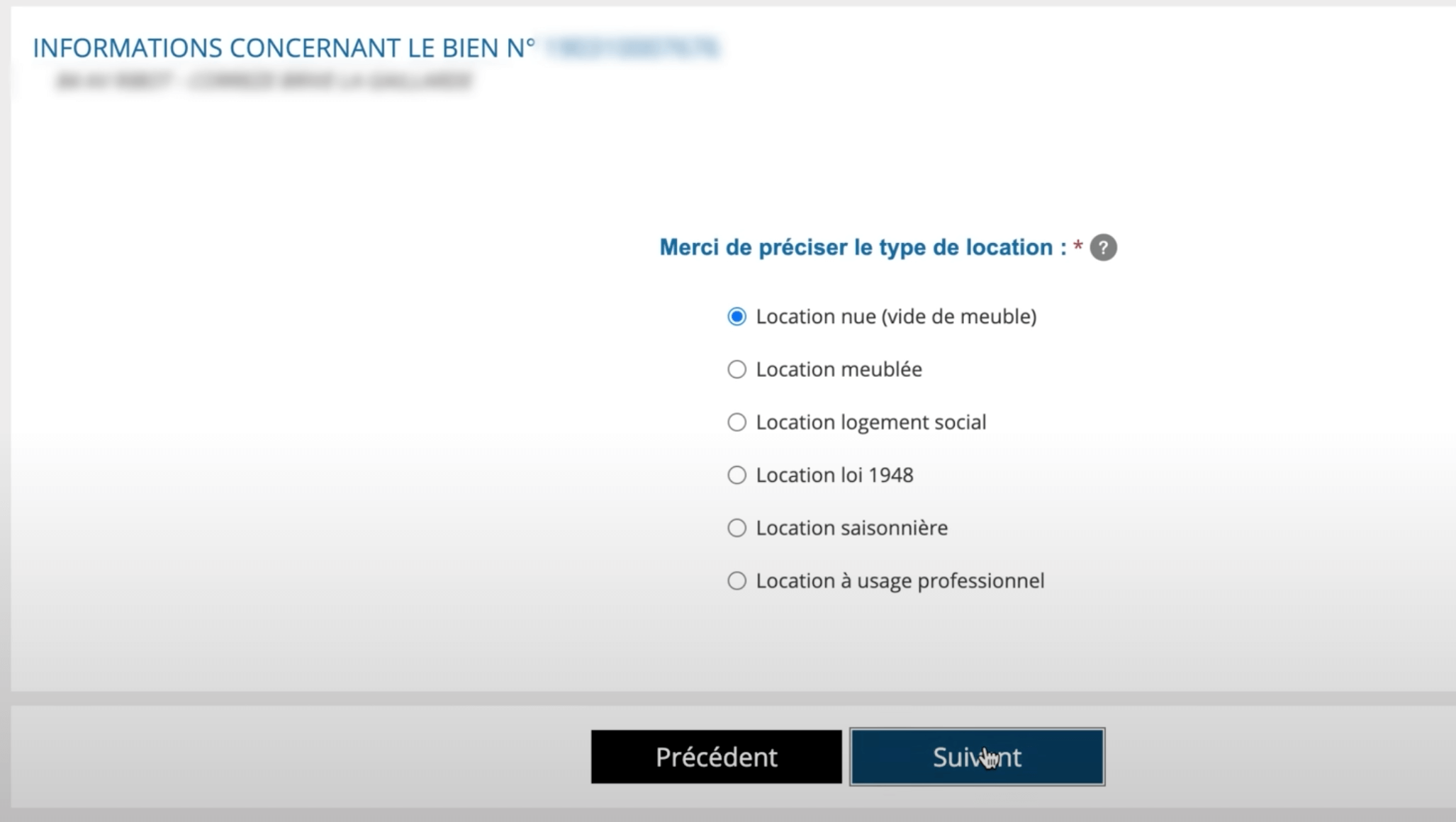

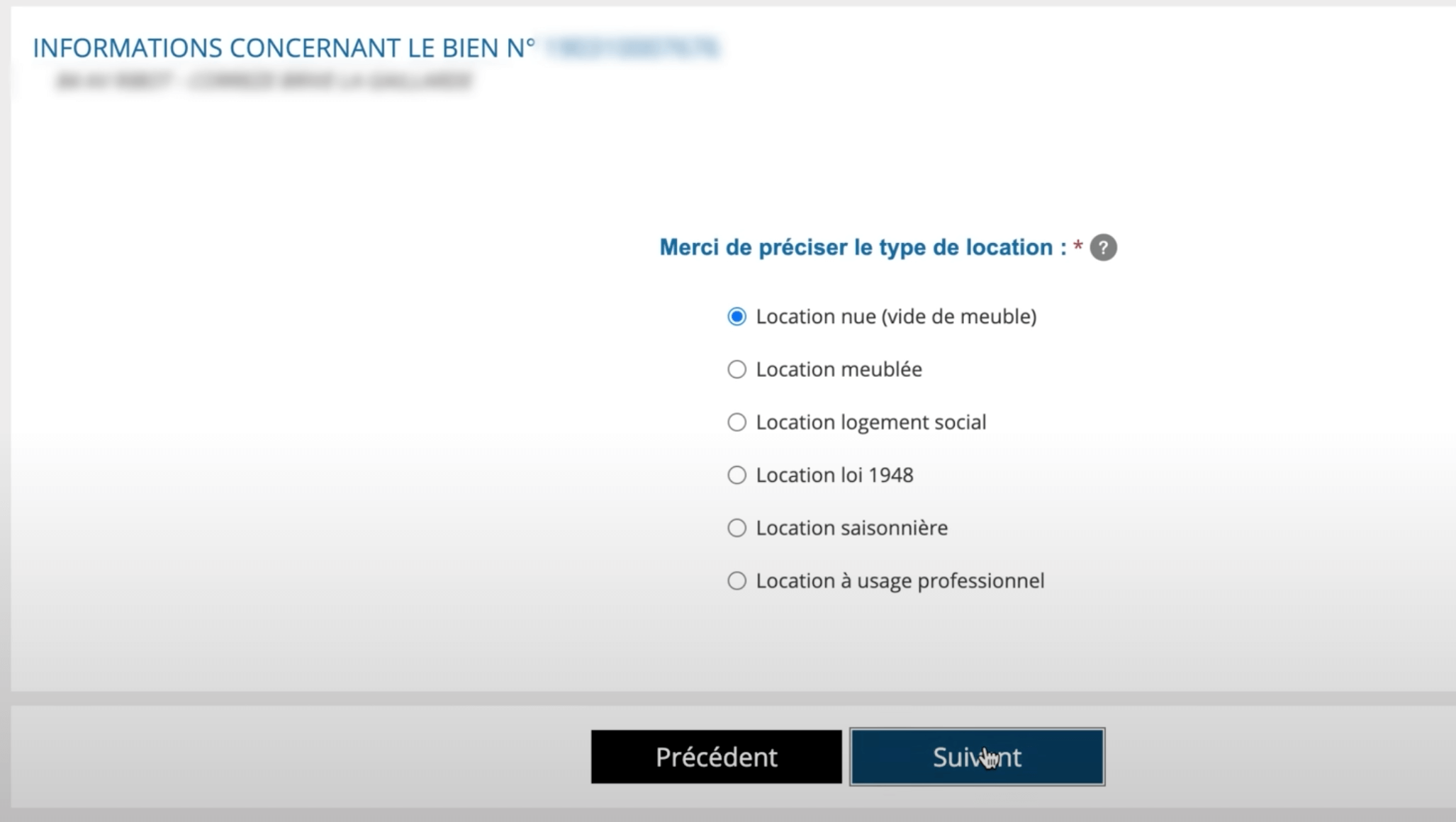

4- Specify the type of rental from among the following choices:

- unfurnished rental (empty of furniture)

- furnished rental: lease of at least one year or nine months for a student -seasonal rental

- social housing rental

- 1948 law rental

- rental for professional use

5- List the occupant(s) of the property

Declaring a change of occupant and indicating the name, birthdate, country of origin, department of origin, and municipality of birth.

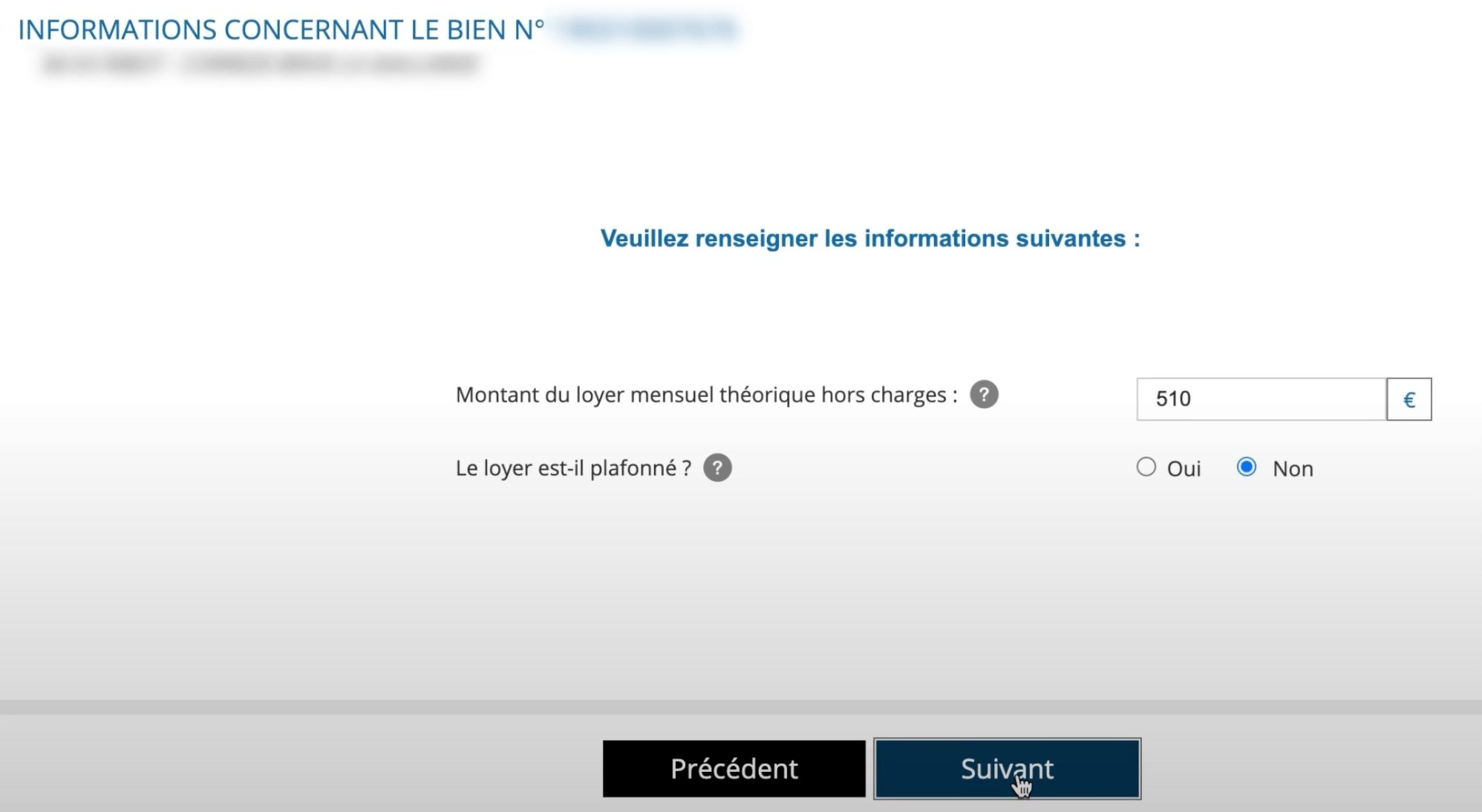

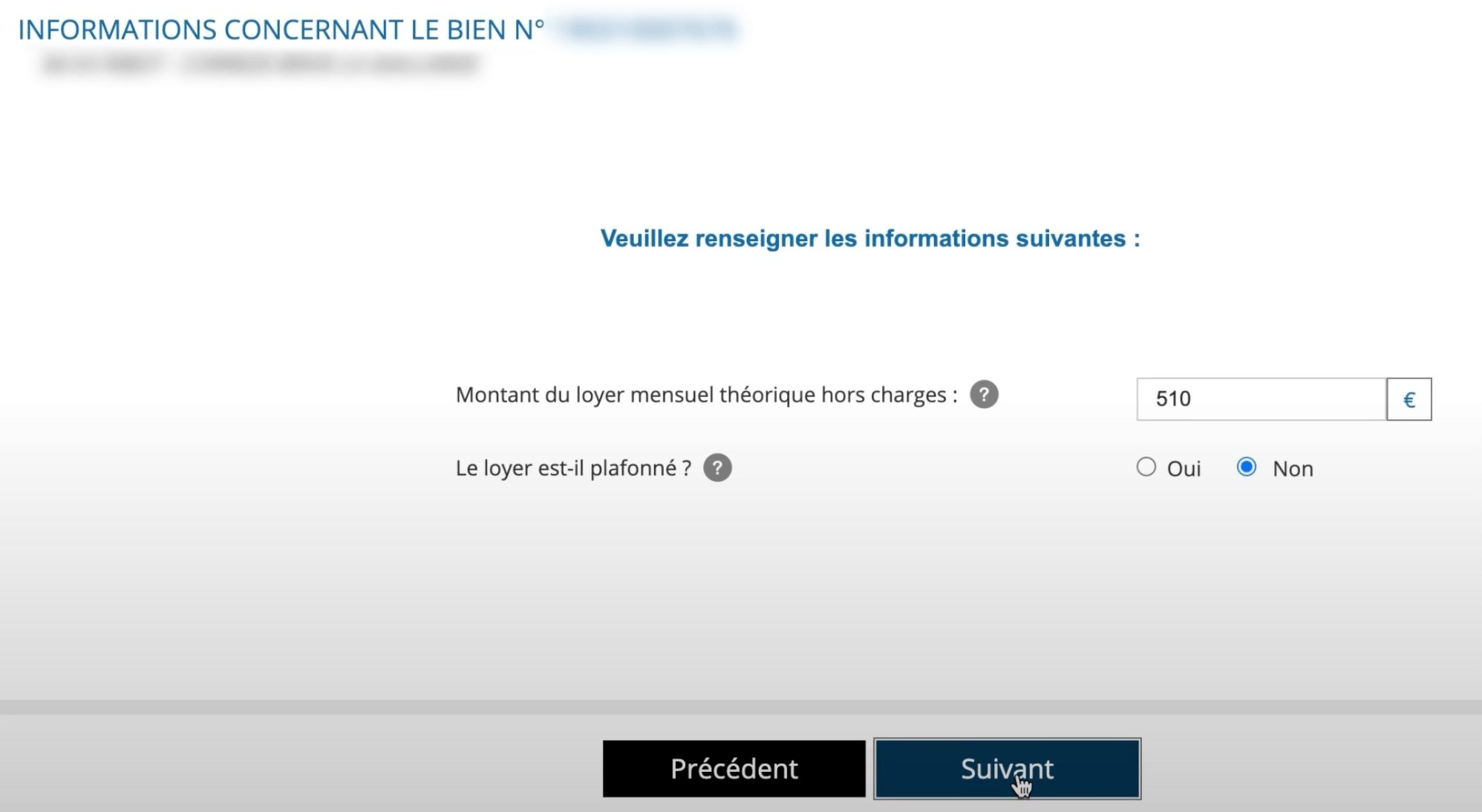

6- Indicate the amount of the monthly rent, excluding recoverable charges, and whether the rent is capped.

7- Read the summary of your declaration, then click on the "Validate and transmit" button.

Do I have to declare rent?

Declaring rent is optional: the owner can skip this step, with no penalty (it's not compulsory), simply by leaving the rent information blank and clicking the "following" button.

The amount of rent to be declared excludes recoverable charges (such as maintenance of common areas, water or gas consumption, household waste collection tax or TEOM).

Do I have to declare a vacant property?

Yes, you must declare your vacant property (unfurnished and unoccupied).

You must declare :

- The start date of the vacancy period (mandatory).

- The end date of the vacancy period when the property is no longer vacant

Is a landlord required to declare their rental property managed by a real estate agency?

The declaration of occupancy is the landlord's responsibility, even if they delegate the property management to a Real Estate agency.

To avoid having to provide your tax number, you must fill in your tax return personally via your personal space.

The "Gérer mes biens immobiliers" service is a new obligation imposed by the French tax authorities.

From January 1, 2024, penalties will apply to those who fail to complete this occupancy declaration.

If taxpayers fail to comply with this declaration obligation, they will be liable to a fixed fine of 150 euros per property per year. The same applies to any errors or omissions. It is, therefore, essential to take this step as quickly as possible to avoid unnecessary fines.

Français

Français