To rent an apartment in Paris, many landlords require a local French guarantor, or "Garant" in French, to co-sign the rental lease to ensure the payment of rent. If you are fortunate enough to have found a French guarantor willing to support your lease, renting an apartment in Paris should be much smoother. However, even with a guarantor, the crucial steps are to decide on the type of guarantee your guarantor will provide, either a simple guarantee or joint surety/joint Prudence, and draft a guarantor letter. Here is everything that you need to know about rental guarantors in France.

Who can become your guarantor for your rental apartment in Paris?

In Paris, the requirements for a rental guarantor may vary depending on the landlord or rental agency. However, in general, a guarantor should be someone who resides in France and has a steady income in France (earning at least three times the amount of rent as a monthly salary) that is sufficient to cover the rent and associated leasehold expenses (or recoverable rental charges).

Does the guarantor have to be someone on a CDI work contract?

No specific rule in France that requires the guarantor to be on a CDI work contract (permanent employment contract). However, the owners may prefer tenants with guarantors with a stable CDI job, assuring them that the guarantor will have a regular income to cover the payments.

How to find a guarantor in France?

Here are some options to consider if you are looking for a French guarantor to rent an apartment in Paris:

- Family or Friends: You could approach someone you know and trust who lives in France, such as a family member or a friend, to be your guarantor

- Rental Guarantee Company: Another option is to use a rental guarantee company, such as Garantme. These companies act as guarantors for tenants and provide a rental guarantee for their landlords in case of nonpayment of rent. They usually charge a fee, and you'll need to meet their eligibility requirements.

- Bank Guarantee: You can obtain a bank guarantee from your bank or financial institution.

What's the difference between a simple Guarantee and a Joint Surety/Joint Prudence?

Simple Guarantee (caution simple):

A simple guarantee is a type of guarantee in which the guarantor is only responsible for paying the rental debt (rent, charges, and repairs) if the tenant fails to do so. In this type of guarantee, the guarantor's liability is limited to a specific amount. In addition, the guarantor has no obligation to pay the debt unless the borrower defaults on the loan.

Joint surety (caution solidaire):

On the other hand, a joint surety/prudence (caution solidaire) is a type of guarantee in which the guarantor is responsible for the total amount of the debt, regardless of the tenants' actions. This type of guarantee provides more protection for the landlord as it eliminates the risk of default by the tenant.

A simple guarantee limits the liability of the guarantor, while a joint security/ joint surety makes the guarantor fully responsible for the nonpayment.

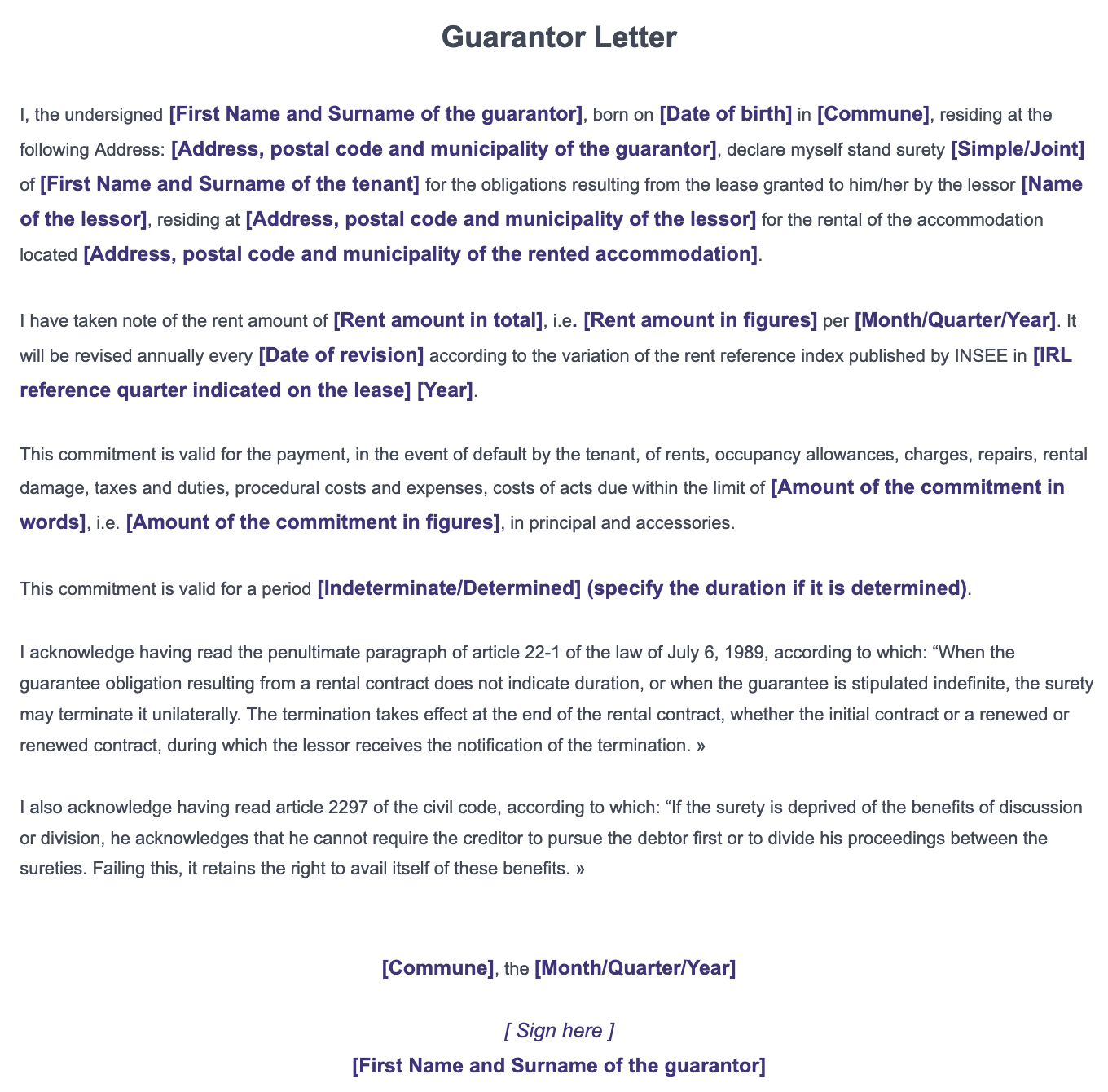

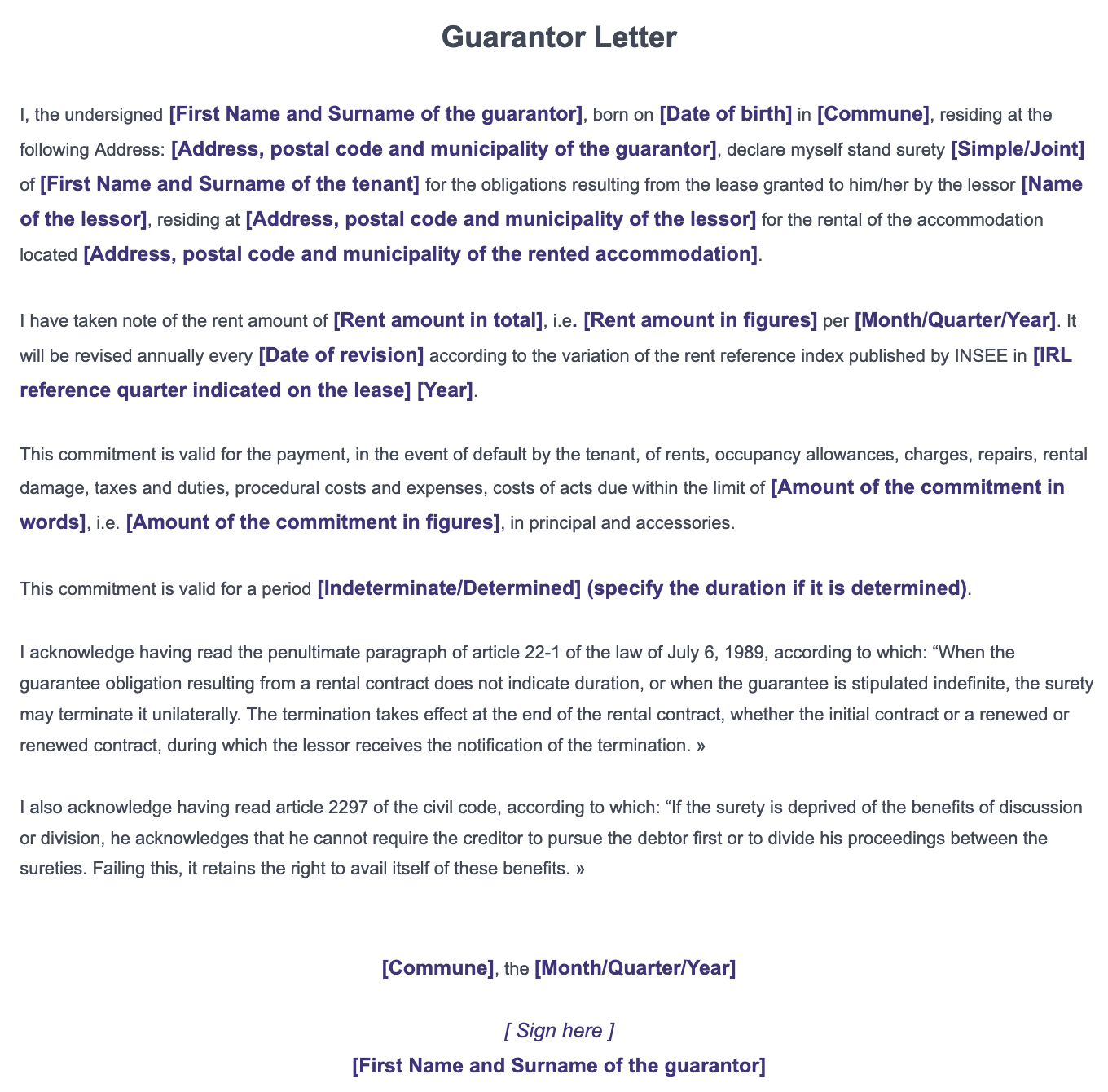

How to write a guarantor letter for a tenancy agreement in France?

The letter of guarantee (acte de caution solidaire ou simple) must be fulfilled through a written document, in the form of a private signature act, without the need for a notary present. And it is essential to note that a guarantor letter in France is legally binding. Therefore, as a guarantor, you should carefully consider your ability to fulfill the rental payment obligations before providing a guarantee. It is also a good idea to have a legal review of the guarantor letter to ensure it meets all legal requirements.

What should be mentioned in a French Guarantee Letter?

The following references are essential :

- The rent amount should be both in numerical and written form.

- Conditions for reviewing the rent are stipulated.

- The maximum amount of security vouched by the guarantor. Otherwise, the guarantor commits to all of the tenant's debts.

- A clear statement indicating that the guarantor is fully aware of the nature and scope of their guarantee commitment.

- The type of engagement required, can be either a simple guarantee or a joint surety.

Which documents to provide for completing a rental guarantee in France?

In addition to the signed guarantee letter, the guarantor must provide the following document to justify their identity, home address, professional activities, and financial status:

- A valid proof of identity if the guarantor is a person: an identity card, a passport, or a driver's license.

- A proof of residence: the last three months' energy bills (gas, water, electricity) for the previous three months.

- Proof of professional activity, such as an employment contract.

- One or more proofs of income proving that the guarantor has sufficient financial means to cover the rental costs in case of the tenant's nonpayment. These can be the last three payslips, the previous tax notice, the latest bank statements, the newest notice of property tax, etc.

French guarantor letter template 2023 & English translation:

What to do in case of nonpayment of rent in France?

How to deal with unpaid rent with a "Simple Guarantee" in France?

When the tenant does not pay the rent, the owner should first contact the tenant by sending a command to pay drafted by a commissioner of justice. Despite this process, the landlord can contact the guarantor if the tenant fails to pay the rental debts.

What to do if the tenant does not pay the rent with a Joint and Several Guarantees (joint surety)?

The owner can directly contact the guarantor from the 1st nonpayment, without even going through the tenant, regardless of whether the tenant can pay their debt. First, however, the owner should inform the guarantor by registered letter.

If the guarantor cannot pay the rental debts, the landlord can ask for delayed payment by seizing the court. If the lease includes a resolving clause, the lease termination (pre-eviction) can automatically be ordered by the judge. However, if the situation worsens, the judge may also decide to terminate the lease and evict the tenant after examining the circumstances, known as judicial termination. However, a bailiff must be involved to initiate the rental eviction/expulsion process in France.

How to terminate the guarantee/surety commitment in France?

Guarantee without a duration:

The guarantor can terminate the surety's obligation at any time through a registered letter when no specific duration is indicated in the agreement. However, the termination notice given to the landlord is adequate only at the end of the lease. It means that the guarantor must pay the rental debts incurred until the end of the lease, even after the commission's termination.

Fixed-term guarantee:

If the surety includes a specific duration, the guarantor cannot terminate their commitment and must continue to pay any rental debts incurred until the agreed-upon date.

However, the parties involved may have included written provisions in the initial document that terminate the surety's commitment in certain events, such as the tenant's divorce or death.

Note: if the guarantor passes away and there are no instructions in the guarantee agreement, their commitment automatically transfers to their heirs. Therefore, the heirs are responsible for paying the rental debts incurred before the guarantor's death but not after their passing.

While a rental guarantor may provide some additional security for the landlord, the tenant is ultimately responsible for paying all their rent and fulfilling their obligations under the lease agreement. Therefore, the rental guarantee provides extra protection for the landlord if the tenant cannot pay their rental debts.

Editor: Siyi Chen

Sources: service public

Credit Photo@Bastien Nvs

Français

Français