Why Selecting the Right Tenant is Crucial

Between September 2022 and September 2023, the number of reminders for unpaid rent rose by 60% in the Île-de-France region, from 71,000 to 126,000. At the national level, the increase is 30% in France. Finding the right tenant is one of the most important decisions you'll make as a landlord. It's not just about filling an empty property; it's about securing your investment, protecting your peace of mind, and ensuring a smooth rental experience. Poor tenant choices can lead to unpaid rent, property damage, and sometimes even legal battles. On the other hand, a reliable tenant can make your life as a landlord much easier, providing a steady income and minimizing the headaches of managing a rental property.

The key to a successful rental is selecting tenants who are financially stable, responsible, and respectful of your property. In this blog post, we'll discuss the essential criteria to look for in tenants, tools to help landlords with the tenant selection process, and how specialized services like Paris Rental Agency, leader in long-term furnished rentals in Paris for international customers, can assist you in finding reliable tenants.

The Importance of Viewings in Tenant Selection

Property viewings are among the most effective ways to assess potential tenants. This is your opportunity to meet applicants face-to-face, allowing you to see their interests, ask questions, and better understand whether they’d be a good fit for your property.

While holding open viewings and inviting multiple candidates at once, may save time for the owner and the agency, but Paris Rental prefers individual appointments. This approach allows for deeper conversations with each candidate and provides an opportunity to observe how they interact with the apartment. It also helps keep the process smooth and stress-free by avoiding the confusion that comes with managing multiple people at once.

However, if you live far away or don’t have the time to manage the viewing process personally, it’s a good idea to consider working with a professional agency. These agencies can handle everything from arranging viewings to accessing potential tenants, saving you time and hassle while ensuring you still find the right fit for your property. Their expertise can provide you with a sense of reassurance and confidence in the tenant screening process.

What Documents Landlords Can Check—and What They Can't

When screening tenants, know what rental documents you can legally ask for and what's off-limits. In France, Decree No. 2015-1437 outlines what landlords can request during the rental application process.

Documents The Owner Can Ask from the Tenant

A. Proof of Identity (with photo)

The landlord may request one of the following identity documents:

- National ID card (French or foreign).

- Passport (French or foreign).

- Driver's license (French or foreign).

- Residence permit or any document proving the right to stay in France (for foreign tenants).

B. Proof of Address

The landlord may request one document to prove the candidate's current address, such as:

- The last three rent receipts, or if unavailable, a letter from the previous landlord confirming that the candidate has paid rent and charges on time.

- A certificate of address from an accredited organization.

- A letter from the host confirming the tenant lives at their address.

- A recent property tax statement or proof of ownership of their main residence.

C. Proof of Employment

The landlord may ask for one or more documents to confirm the candidate's professional status, such as:

- A work or internship contract or a letter from the employer specifying the job, salary, and start date (including trial period details if applicable).

- A K or K-bis extract (less than 3 months old) for commercial businesses.

- An original D1 extract from the trade register (less than 3 months old) for artisans.

- A certificate of identification from INSEE (for self-employed workers).

- A professional ID card (for freelance professionals).

- Any recent document proving professional activity (for other professionals).

- A student ID or a current enrollment certificate (for students).

D. Proof of Income

The landlord may request one or more documents to prove the candidate's income, such as:

- The most recent or second-to-last tax return (or an equivalent if income was earned abroad).

- The last three pay slips.

- Proof of internship payment.

- The last two financial statements or an income certificate from an accountant (for self-employed individuals).

- Proof of pension, retirement, allowances, or social benefits received in the last three months.

- A letter or simulation of housing aid.

- A scholarship award letter (for students receiving scholarships).

- A property title or a recent property tax statement.

- Proof of rental income, annuities, or investment income.

Documents You Can't Ask For

Landlords can't ask potential tenants for private documents like bank statements or anything irrelevant to the rental, such as social security cards or police records. It's essential to be aware that landlords who request prohibited documents from tenants risk facing a fine of up to €3,000 for a person and up to €15,000 if the landlord is a legal entity, such as a Société Civile Immobilière (SCI). This knowledge can help you navigate the tenant screening with caution and awareness.

Key Criteria for Selecting Tenants

Several important factors should be considered when choosing a tenant. These criteria will help you assess whether a potential renter will meet their obligations and treat your property carefully.

Financial Stability

As a landlord, your role in ensuring financial stability is pivotal in tenant selection. Whether the rent is paid directly by the tenant, their parents, or an employer, your diligence is key to feeling confident that the rent will be covered consistently and without issues. A general rule of thumb is that the rent should ideally not exceed 30% of the payer's monthly income, leaving enough room for other expenses and reducing the likelihood of late or missed payments.

Here's how you can approach different scenarios:

-

When the tenant pays directly: It is crucial to verify that their income is sufficient to cover the rent. Typically, their monthly net salary is at least three times the rent. Requesting documents like recent pay stubs and tax returns is a thorough way to assess their financial history and stability, providing security and reassurance in your tenant selection process.

-

If the tenant's parents are paying: In situations where parents are financially responsible, such as with student tenants, it's essential to assess their financial stability. If the parents are paying their child's rent and they rent their own home, you should take into account their additional rental expenses. In this case, their combined monthly net income should ideally cover both their rent and the child's rent, with the same rule applying — their income should be at least three times the total rent amount. For example, if they pay €3,000 for their rent and €1,000 for their child, their combined monthly income should be at least €12,000.

If the parents own their home, their financial situation is generally more stable. In this case, their monthly net income should be at least three times the child's rent to ensure they can comfortably cover it without straining their budget. For example, if the child's rent is €1,000, their combined monthly income should be at least €3,000.

It is a good practice to request proof of income, such as recent pay stubs, tax returns, or savings, from the parents to ensure they can reliably cover the rent.

-

If an employer is paying: For corporate rentals or expatriates, the tenant's employer may be responsible for housing costs. In this case, ask for a formal letter from the company that clearly outlines the employer's commitment to pay the rent and verify the housing arrangement is in place for the entire rental term. Check the company's rent balance sheet and business registration certificate to ensure the employer is financially stable.

However, it's equally important to formalize this arrangement with a written agreement in the lease contract. This step ensures financial stability and solid legal protection, giving you peace of mind in your tenant relationships.

Tip: When verifying the last three pay slips, pay close attention to the year and the evolution of accumulated paid holidays. Compare the totals from one month to the next—if something doesn’t add up, it could be a sign that the documents are not authentic. This small detail can help you spot inconsistencies and avoid fake documents.

Employment Status

A tenant with a stable job is generally more reliable when paying rent on time. Therefore, tenants with full-time, permanent positions (such as those with a CDI - Contrat à Durée Indéterminée) are ideal because their income is more predictable. Freelancers or people on temporary contracts (CDD) may present more risk, but they shouldn't be ruled out if their financial health is solid. For freelancers or people on temporary contracts (CDD), request recent tax returns to verify annual income, proof of ongoing work or contracts to assess income stability, etc.

Rental History

A tenant's rental history offers valuable insight into their past behavior. Ideally, you want a tenant with a proven record of being responsible. Request the last three rent receipts and references from previous landlords to learn if they paid rent on time, took care of the property, or had any conflicts with neighbors if you have any doubts.

Personal Guarantors or Company Guarantee

It's always a good idea to ask for additional security when possible. Many landlords request a personal guarantor, often a parent or close relative, who will take responsibility for the rent if the tenant cannot pay. This option is handy for younger tenants or those with limited credit history. Alternatively, you can ask for a company guarantee in corporate rentals, where the employer guarantees rent payment. Another option is to have tenants subscribe to rent insurance such as "Garantme," which provides financial coverage in case of payment defaults. These extra safeguards significantly reduce your financial risk as a landlord.

Essential Tools for Landlords: Verifying Tenant Documents and Selecting Reliable Tenants

Today, landlords have access to many practical tools and methods to evaluate potential tenants and select the best candidate. Here are some of the most useful ones:

DossierFacile: A Trusted Tool for Verified Tenant Applications in France

For landlords in France, DossierFacile is a free government-backed platform that helps tenants compile and verify their rental applications. It simplifies the process by ensuring all necessary documents are in order and trustworthy. Landlords receive a fully verified, easy-to-read rental dossier, significantly reducing the risk of fraudulent documents.

Reference Checks - Document Verification Tools

One of the growing concerns for landlords is verifying the authenticity of the documents provided by potential tenants, such as pay stubs or tax returns. Fortunately, some tools can help with this process:

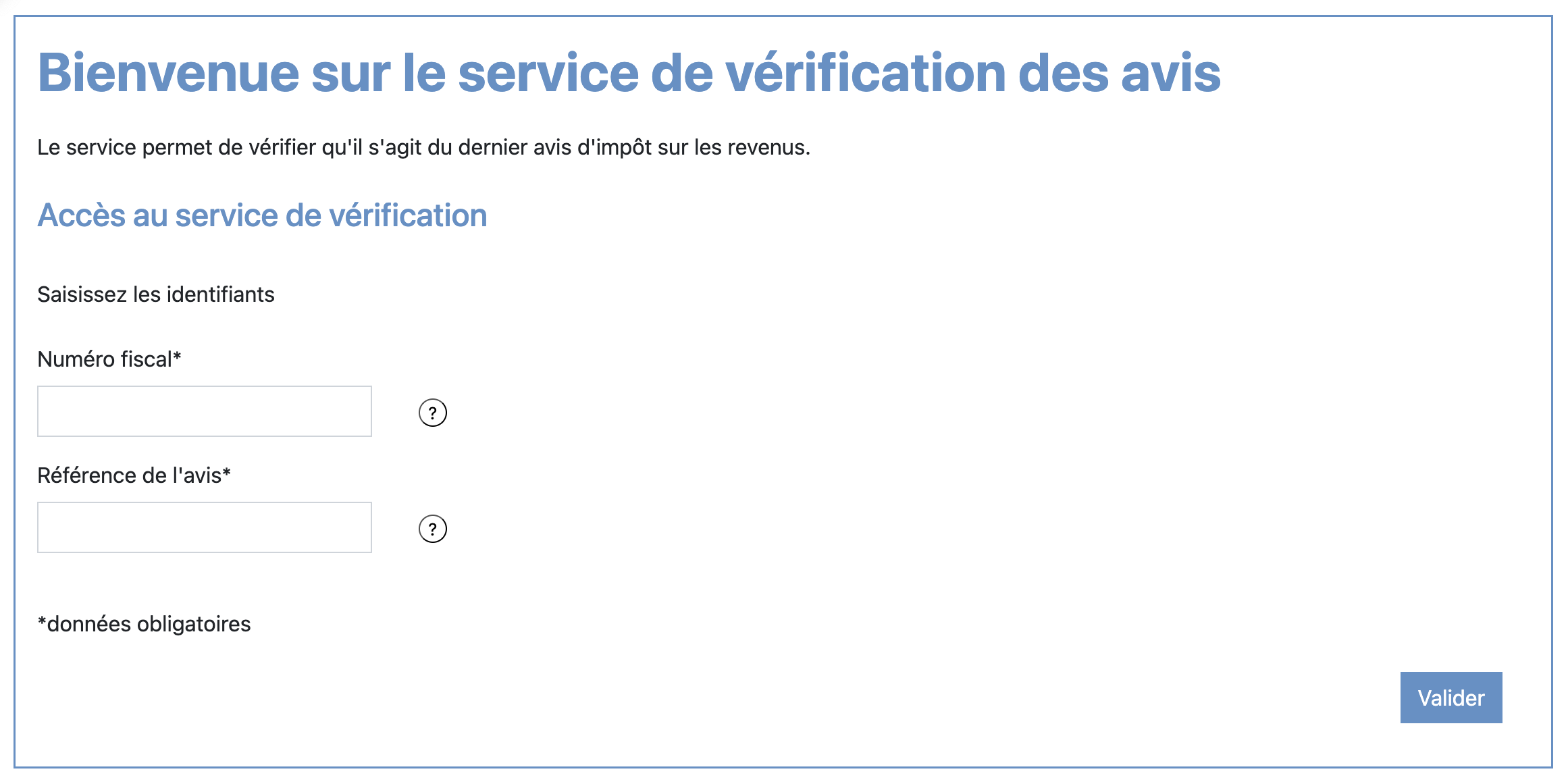

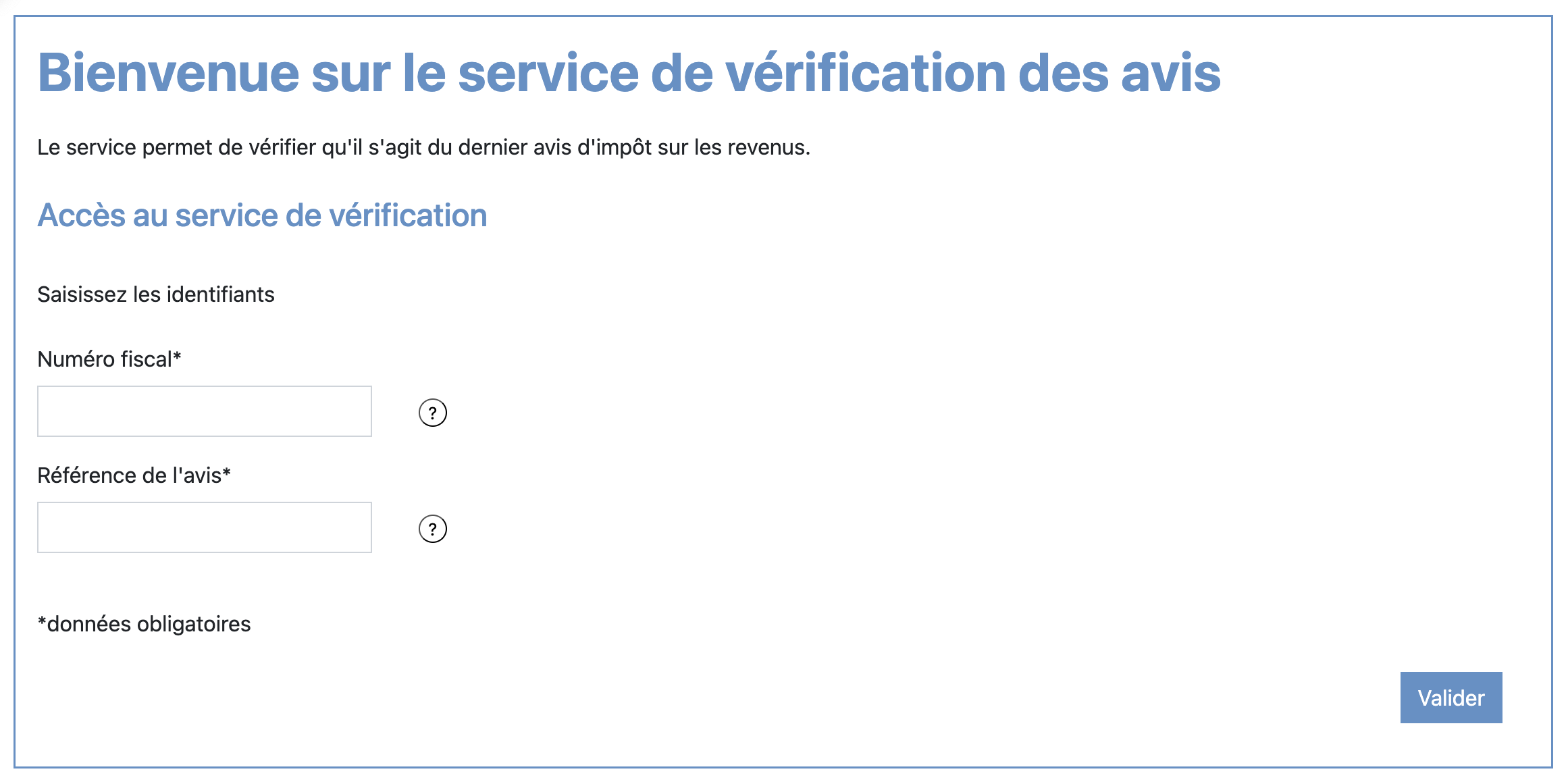

VerifAvis: VerifAvis is a French government's platform that verifies the authenticity of tax documents, such as “avis d'imposition” (tax notice), assisting landlords to confirm the legitimacy of income claims.

Vialink: This tool helps to verify the identity with an easy and fast biometric identification solution (Face Matching and Liveness detection).

Social media: Social media platforms, like LinkedIn, can also be helpful tools for checking the professional information provided by the tenant. By looking at their LinkedIn profile, you can quickly learn about their job history—like the start and end dates of their work contracts, their job titles, and the company they work for. It’s a simple step that can give you extra peace of mind, ensuring their information is accurate and matches their official documents.

Contact previous landlord or agency

Contacting a prospective tenant's previous landlords can provide valuable insight into their behavior. Were they consistent in paying rent? Did they take care of the property? Did they maintain good relationships with neighbors? These insights can help you form a clear picture of the tenant's habits and reliability.

Paris Rental: Protecting Landlords Through Careful Tenant Selection

The rental market in France has become complex, and landlords are looking for reliable solutions to protect their investments, especially as the law favors tenants. When rent goes unpaid, it can be challenging and time-consuming for property owners to recover the funds or evict the tenant, making tenant selection a critical step in protecting their property and financial interests. This is where specialized services like the Paris Rental Agency come into play. Paris Rental specializes in high-end international and corporate clientele, such as expats, companies, and embassies. Paris Rental stands out by meticulously analyzing each potential tenant's financial, professional, and rental history. Every candidate undergoes a deep evaluation, ensuring that only the most stable and financially sound profiles are presented to landlords. This level of scrutiny helps minimize risks and guarantees a more secure rental experience.

By entrusting the tenant selection process to a specialized agency like Paris Rental, landlords save time and gain confidence in the quality of the candidates. This peace of mind is invaluable for property owners who want to protect their investments.

Testimonials and Experiences from Landlords

Here are some testimonials from landlords who have successfully found reliable tenants with the help of Paris Rental:

Dominique. N, Property Owner in Paris:

I have entrusted my apartment for rent to the Paris Rental real estate agency for 17 years. I have always been very satisfied with their wise advice and services, with fairly short latency between two tenants. I appreciate their welcome, seriousness, and professionalism.

Julia. B, Expat in Paris:

My family started as tenants with Paris Rental, and the rental service was already highly professional and a pleasure to use- We then decided to rent our apartment through Paris Rental, who continued for over ten years to provide excellent personalized service and high standard for us as landlords and for our tenants. In 10 years, the number of months the flat was rarely ever unoccupied. Fantastic work!

Editor: Siyi CHEN

Français

Français