Many expatriates - French people muted abroad or foreign investors who have invested in real estate in Paris or its vicinities - ask themselves how to rent out their accommodation from abroad. Property management will be critical for expatriates, for they will be away.

Several reasons that can entice expatriates to rent out their accommodations during their stay abroad are:

Whatever your reasons, here are the best ways to rent out your property without taking too many risks.

How to manage your overseas property remotely?

Ideally, you could have someone you trust on-site. However, calling on family or friends can only last a while. Indeed, if several water damages take place -a regular occurrence in Paris and co-ownership buildings- you risk putting yourself in harm's way with your loved ones. Also, managing water damage and finding a competent plumber on weekends, for example, talking to neighbors, the trustee, and insurance experts, is a job!

It is better to contact a Property Management professional from the start. Property Management is a profession that requires specific knowledge and regular attention. Also, hiring a Real Estate agency that offers both a long-term rental service -replacing the tenant in the event of early departure- and a Property Management service is a perfect solution. The Property Management experts tend to the maintenance of the dwelling, see to the payments of the rent by the tenant and settle the owner's syndic monthly bills.

However, we do not recommend online Real Estate agencies to expats because it is impossible to have a contact person. And when you live far away and are out of phase, you need to be reassured by a managing expert who knows your property personally.

Among the real estate agencies that have an address and can be reached, be aware that some have attractive prices like 5%, for example, which do not make it possible to assure proper management of your property. If you face unexpected problems and need additional services, you will pay out-of-bundle costs above the 5% fee. In the end, it will cost you more than a seemingly more expensive fee in other agencies that cover all services and take full responsibility for your property. A true relief for the expatriate owner abroad! A global Property Management service generally costs 10% and includes all services and taxes (TVA 20%).

Such an agency as "Home Management'' subsidiary of the renowned company Paris Rental, provides complete and detailed Property Management in Paris. In addition, with the Paris Rental Association, "Home Management" offers tenants from multinational companies a free "Owner Space" whereby you can read comments following visits and those from your tenants.

For many expatriates, maintaining a place in their country of origin constitutes security and a home base. In addition, a Property Management company allows you to prepare for the future with complete peace of mind.

Should you sell and no longer be concerned about your far-away investment?

When thinking of selling, the owner and the investor must consider the property's acquisition date, measure the success probability of their expatriation, and the chances of returning to France.

Indeed, selling their Parisian property and re-entering the real estate market 3 or 5 years later when back to France could be an unpleasant surprise. In Paris, as elsewhere, the real estate market will likely evolve upwards. Therefore, investors should consider the importance of keeping a property in the Eurozone, where the currency is stable and offers a chance of long-term capital gains.

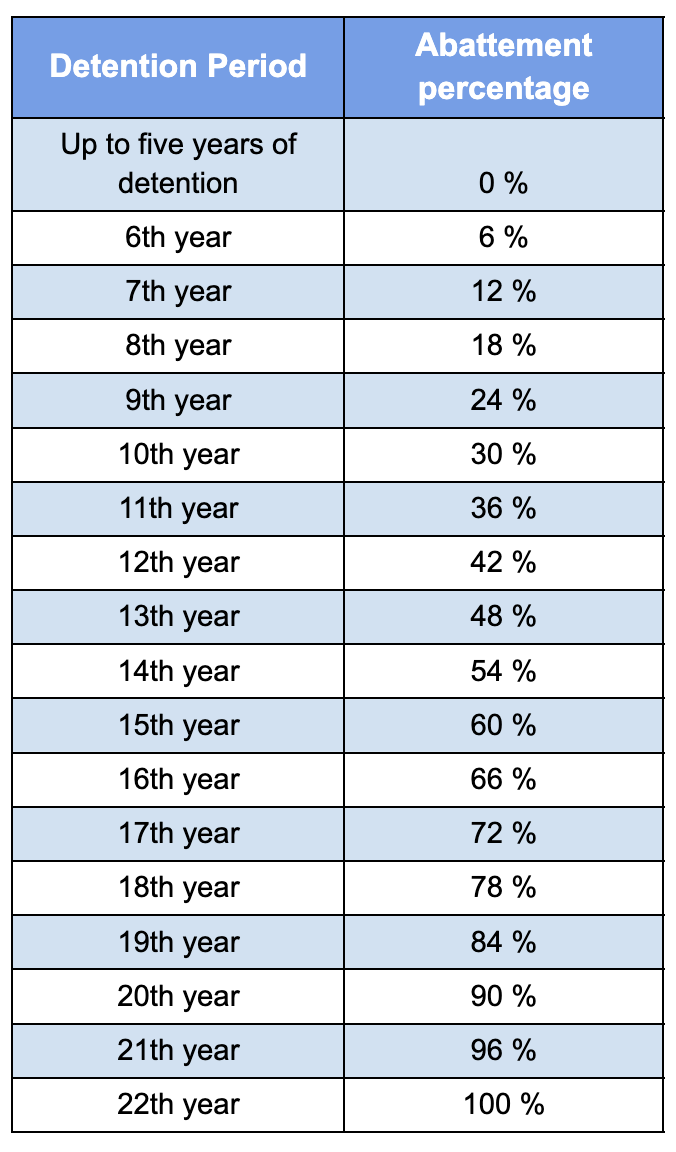

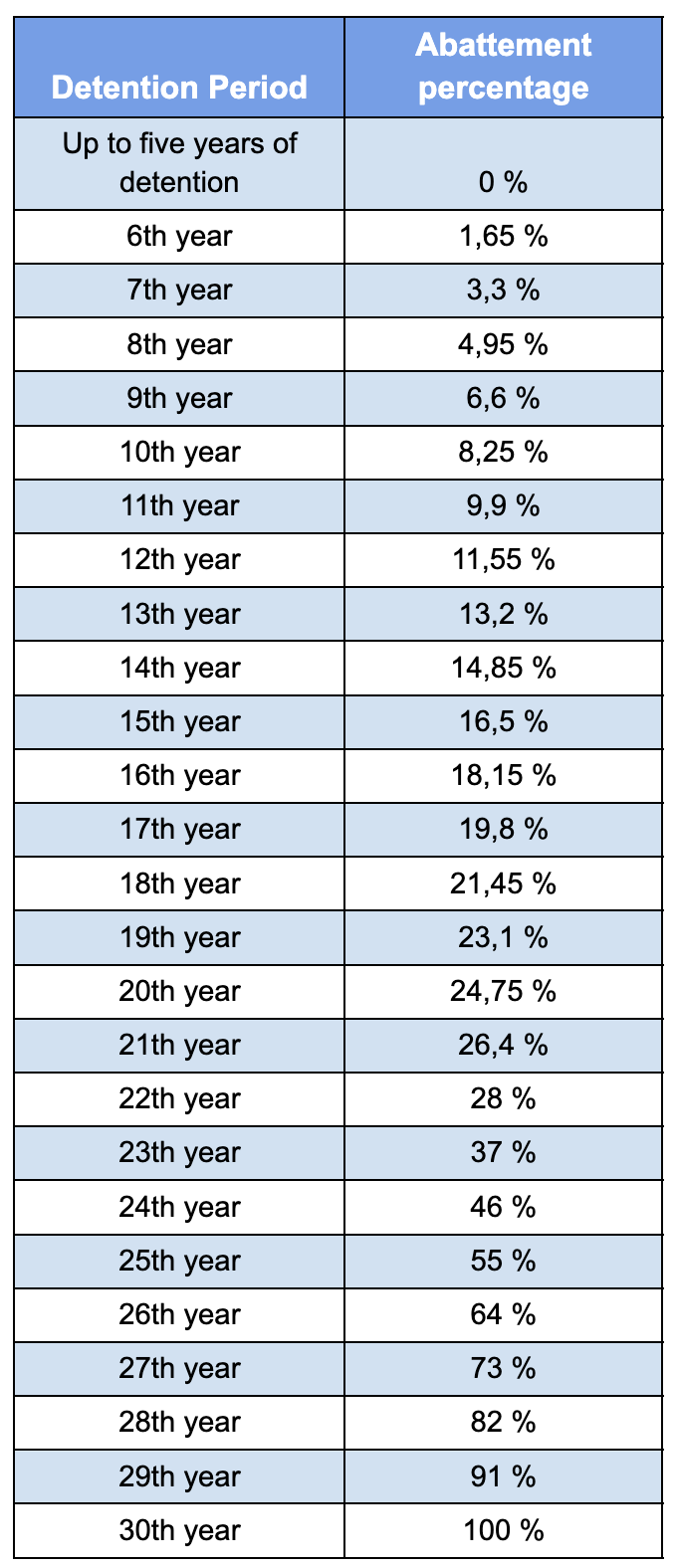

For the owners and investors who wish to sell their property, here is a complete informative table:

Calculation of income tax deductions based on detention's duration

Deductions from income tax are established as follows:

- 6% for each year of ownership beyond the fifth year and up to the twenty-first;

- 4% for the twenty-second complete year of ownership.

Thus, the total exemption of real estate capital gains from income tax starts at the end of a holding period of 22 years.

Français

Français