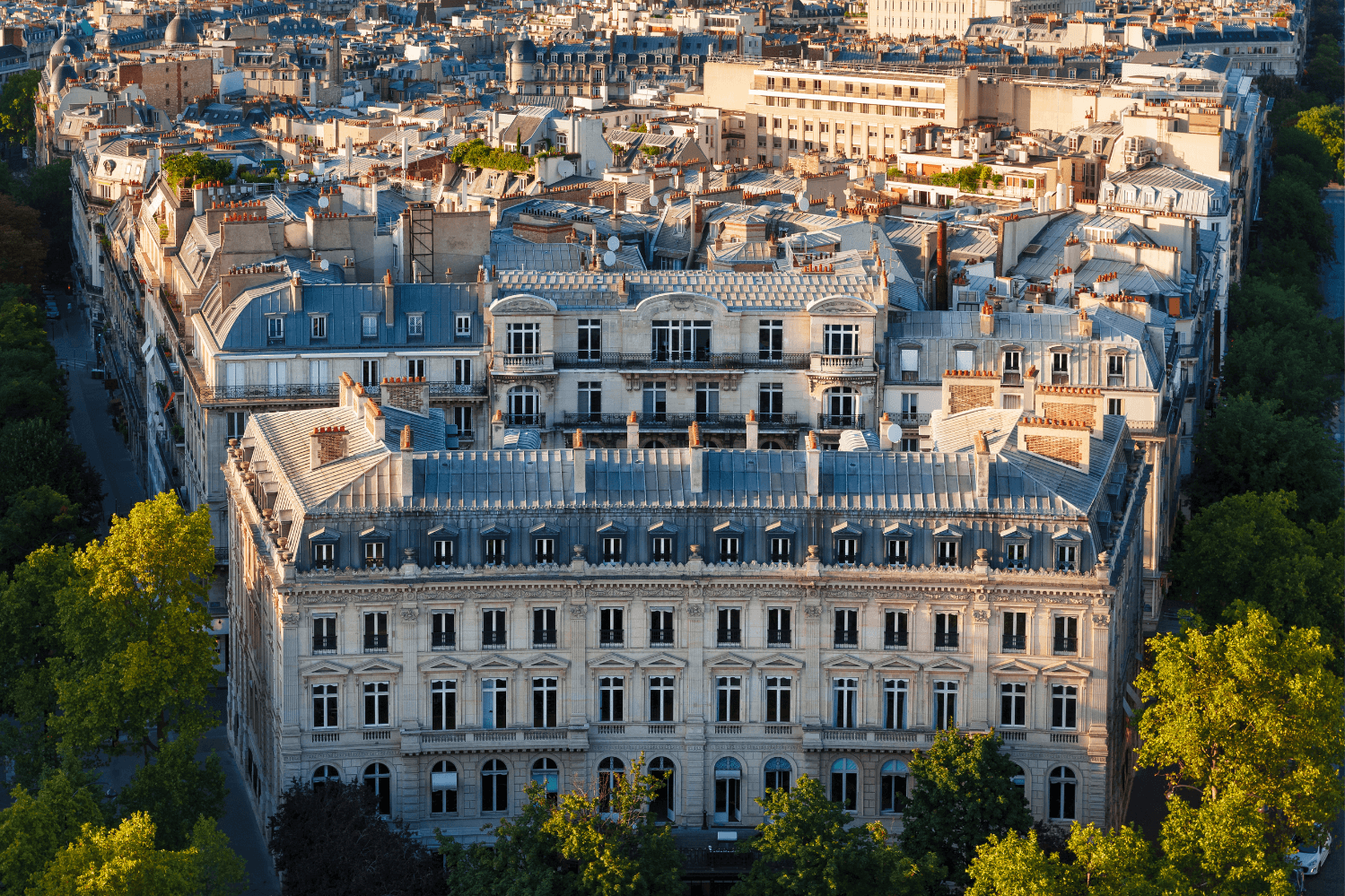

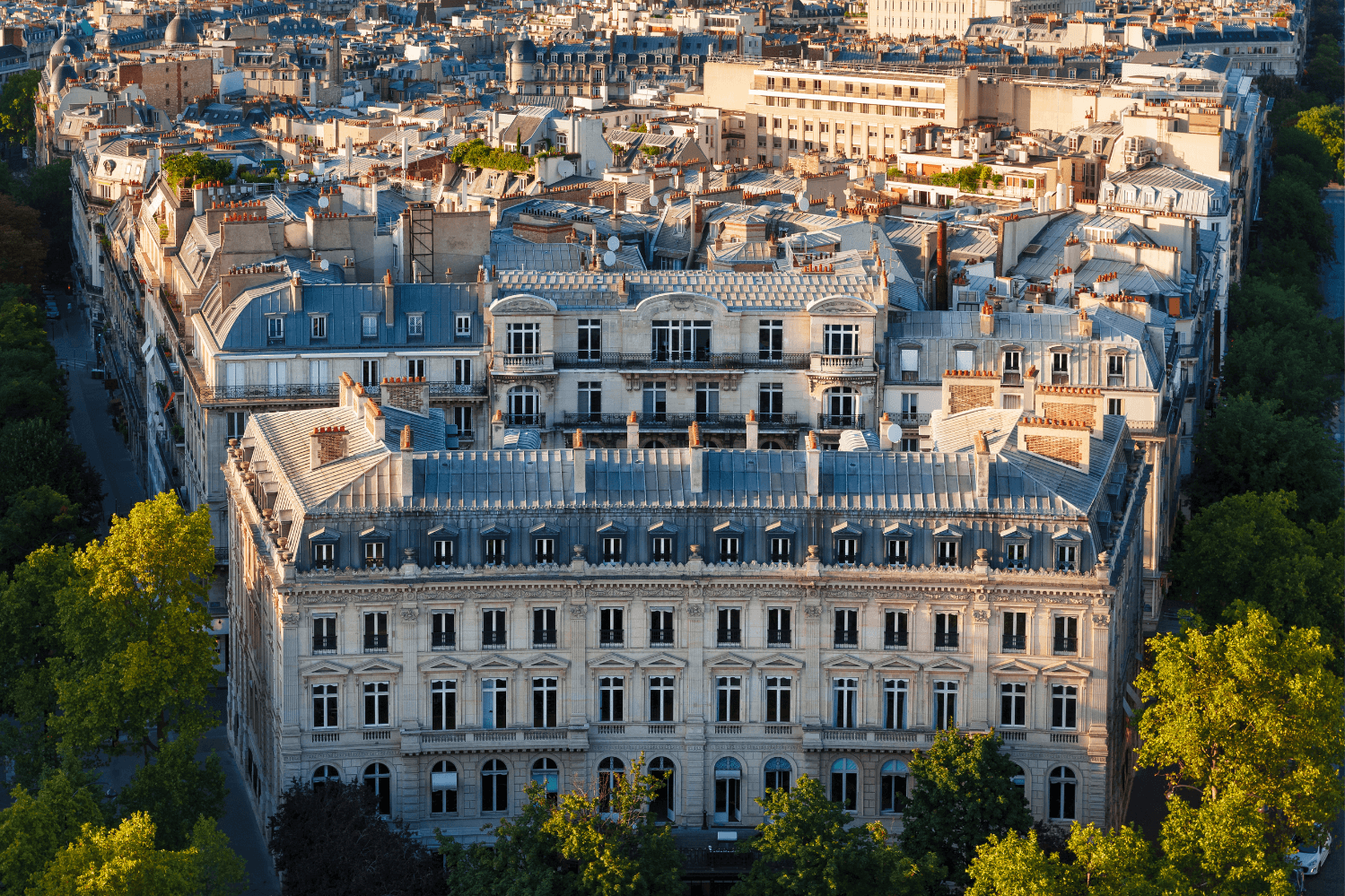

Buying property in France as an expatriate is a significant decision that requires a deep understanding of the applicable tax regulations. From notary fees (frais de notaire) to property taxes like taxe foncière and taxe d’habitation, understanding the potential costs involved can help you avoid surprises. Whether you’re purchasing a home to live in, a vacation home in Paris, or renting it out, this guide will break down the key tax considerations for expats before investing in real estate in France and help you navigate the process of buying property tax-efficiently.

Taxes related to the purchase of real estate

Transfer Duties (Droits de Mutation):

Transfer duties are the registration fees you pay when buying or selling a property. These fees cover the cost of updating official records (such as changing the owner's name) and are levied by the government. The amount depends on the property's type (e.g., house, apartment) and location.

- For an old property, the transfer duties amount to approximately 5.8% of the sale price.

- For new property (less than 5 years old), they are exempt from transfer duties but subject to VAT.

Notary Fees (Frais de notaire):

Notary fees, which include various components, typically range from 7% to 8% of the purchase price for old properties and 2% to 3% for newly built properties. These components of notary fees include:

1. Notary's remuneration (emoluments):

The state regulates notaries' remuneration as they perform a public interest function, typically accounting for 1% of the property value. The calculation is based on a tiered structure:

- 3.870% for the portion of the property price up to €6,500.

- 1.596% for the portion between €6,500 and €17,000.

- 1.064% for the portion between €17,000 and €60,000.

- 0.799% for the portion above €60,000.

Notaries may also offer a discount of up to 20% on the fee portion above €100,000, and in some instances (e.g., offices, social housing), this discount can be increased to 40% for transactions exceeding €10 million.

2. Disbursements (Débours)

These correspond to expenses advanced by the notary for third-party services, such as fees for external contributors and the cost of obtaining necessary documents. For example, photocopying costs required to complete the transaction are considered disbursements and are billed separately.

3. Land Registration Tax (Taxe de Publicité Foncière - TPF):

The land registration tax (TPF) is allocated to the state or local authorities, depending on the circumstances (assessment and collection fees). The amount varies depending on the department and, more importantly, the age of the purchased property:

- Normal rate applies to the purchase of an old property.

- Reduced rate applies to the purchase of a new property or one under construction.

Details of the Land Registration Tax (TPF)

Commune 1.20%

Department 3.80%

Assessment & collection fees 2.37%

= Maximum global rate 5.81%

4. Security contribution fee:

A minor fee that ensures the registration of the property transaction, usually 0.10% of the sale price.

Value Added Tax (VAT) on New Properties:

For new properties, a 20% VAT may be apply instead of transfer duties. However, in certain cases, exemptions or reduced VAT rates (as low as 5.5%) may be available, depending on factors such as the property's location, purpose, or buyer eligibility.

Tax Obligations for Expatriate Property Owners

1. Declaration of Real Estate in France

Any expatriate who owns property in France must submit an annual property declaration to the French tax authorities. This applies even if the property is not rented out, as it must still be included in the annual tax declaration. In general, after submitting the online tax declaration, property owners who file electronically will be automatically redirected to the online property declaration service.

However, if you were not the property owner as of January 1 of the relevant tax year, the responsibility for declaring occupancy rests with the previous owner.

The purpose of this declaration is to clarify the occupancy status of the property—whether it is occupied by the owner, rented to tenants, vacant, or provided to guests free of charge. Owners must also provide the identity of the occupants and the relevant period of occupancy.

2. Property Taxes in France for Foreigners: Taxe Foncière & Taxe d’Habitation

Property Tax (Taxe Foncière):

If you own property in France, you’ll need to pay taxe foncière, a property tax levied on all homeowners—even if you are a non-resident. It is calculated based on the cadastral rental value and the rate applied by the local municipality.

Housing Tax (Taxe d'Habitation):

Many expats wonder: Are expats exempt from taxe d'habitation? The council tax for primary residences has been abolished. Still, it applies to secondary residences, which are properties not the owner's main home and are used occasionally, such as vacation or investment properties. Therefore, if you're buying a second home in France, it's important to factor in the housing tax for second homes.

Additionally, suppose your property has been vacant for residential use for more than 12 consecutive months in areas with a housing shortage (zones tendues), such as Paris. In that case, you may also be subject to vacant home taxes in France.

Exemptions or reductions may be applied based on specific criteria (income level, location, nature of the property).

3. Rental Income Taxation

If you’re renting out property in France, you’ll need to pay rental income tax—even if you’re a non-resident. The applicable taxation regime varies based on whether the property is furnished or unfurnished and the annual rental income with different deductions available. Additionally, social charges on French rental income may apply, increasing the overall tax burden.

Unfurnished Rentals (Location Nue):

In the case of unfurnished (bare) rentals, the landlord is taxed under the "revenu foncier" (real estate income) category. Two tax regimes apply to unfurnished rentals:

Micro-Foncier Regime:

- Available if annual rental income is below €15,000.

- Provides a flat 30% tax-free allowance, with tax applied to the remaining 70%.

- However, the owner of the unfurnished apartment rental can choose the real taxation regime if deductible expenses exceed the standard allowance. This option is binding for three years and automatically renewed each year unless the owner requests a change.

Régime Réel (Actual Expense Deduction):

If annual rental income exceeds €15,000, this tax regime becomes mandatory and allows landlords to deduct actual expenses. These include repair, maintenance, and improvement costs, management and administrative fees, a fixed €20 for miscellaneous expenses, loan interest, certain taxes like property tax (TFPB), and other specific deductions. By reducing taxable rental income, these deductions help lower the total tax burden.

Furnished Rentals (Location Meublée):

Furnished rentals benefit from a more favorable tax regime, classified under:

Non-Professional Furnished Rental (LMNP - Loueur en Meublé Non Professionnel):

- LMNP tax regime is suitable for landlords whose annual rental income remains below specific thresholds.

- Can be taxed under either the Micro-BIC Regime, offering a 50% allowance, or the Régime Réel, which allows for the deduction of actual expenses.

Professional Furnished Rental (LMP - Loueur en Meublé Professionnel):

- LMP tax regime applies if rental income exceeds €23,000 annually and represents more than 50% of total household income.

- Offers additional benefits, such as social security coverage and potential exemption from capital gains tax under certain conditions.

Impact of Tax Residency on Real Estate Taxation

1. Difference Between French Tax Residents and Non-Residents

- French tax residents are taxed on their worldwide income.

- Non-residents are only taxed on their French-source income, including rental income from French properties.

2. Tax Treaties Between France and the Country of Residence

France has agreements with many countries to prevent double taxation on property income by allowing foreign tax credits, exemptions, or deductions. These agreements specify which country has the primary right to tax income, capital gains, and other real estate-related earnings.

Key aspects of the France-U.S. tax treaty include:

- Taxation of rental income: Rental income from a French property is taxed in France but may also be subject to U.S. tax. However, the U.S. allows a foreign tax credit to offset taxes paid in France.

- Wealth tax considerations: If your real estate assets in France exceed €1.3 million, you could be subject to wealth tax (IFI) France for non-residents. The U.S. does not have a general wealth tax, but France does. Under the treaty, a U.S. resident with assets in France may still be subject to the French wealth tax if applicable.

- Capital gains tax: Thinking about selling property in France as an expat? You may be subject to capital gains tax on French property sales (19%) plus social charges (17.2%), depending on how long you've owned the property. The amount of tax owed depends on how long you've owned the property, with exemptions and reductions available for more extended ownership periods:

- After 6 years: Partial decreases begin.

- After 22 years: Full exemption from capital gains tax (CGT).

- After 30 years: Full exemption from both capital gains tax and social charges.

In addition, for non-french residents, the seller's country of residence may also claim the right to tax the gains. For example, if a U.S. resident sells a property in France, the capital gains tax is primarily owed in France. However, under the France-U.S. double taxation treaty for property owners, the U.S. may also tax the gains but typically allows a foreign tax credit to offset the taxes paid in France, preventing double taxation.

For precise details on a specific country's treaty with France, expatriates should consult the French tax authority or a tax professional specializing in international taxation.

Strategies to Minimize Tax Costs

- Consult a tax specialist in international taxation: An expert can help navigate complex tax regulations and optimize tax obligations.

- Consider advantageous tax regimes: Such as non-professional furnished rental (LMNP) status or creating a Société Civile Immobilière (SCI) for tax and inheritance benefits.

- Utilize tax exemptions: Certain tax exemptions exist in France for first-time buyers and families, including reduced transfer taxes (droits de mutation), VAT reductions (5.5% instead of 20%) in designated urban development zones, and property tax exemptions for newly built homes for up to two years after construction.

Editor: Siyi CHEN

Français

Français