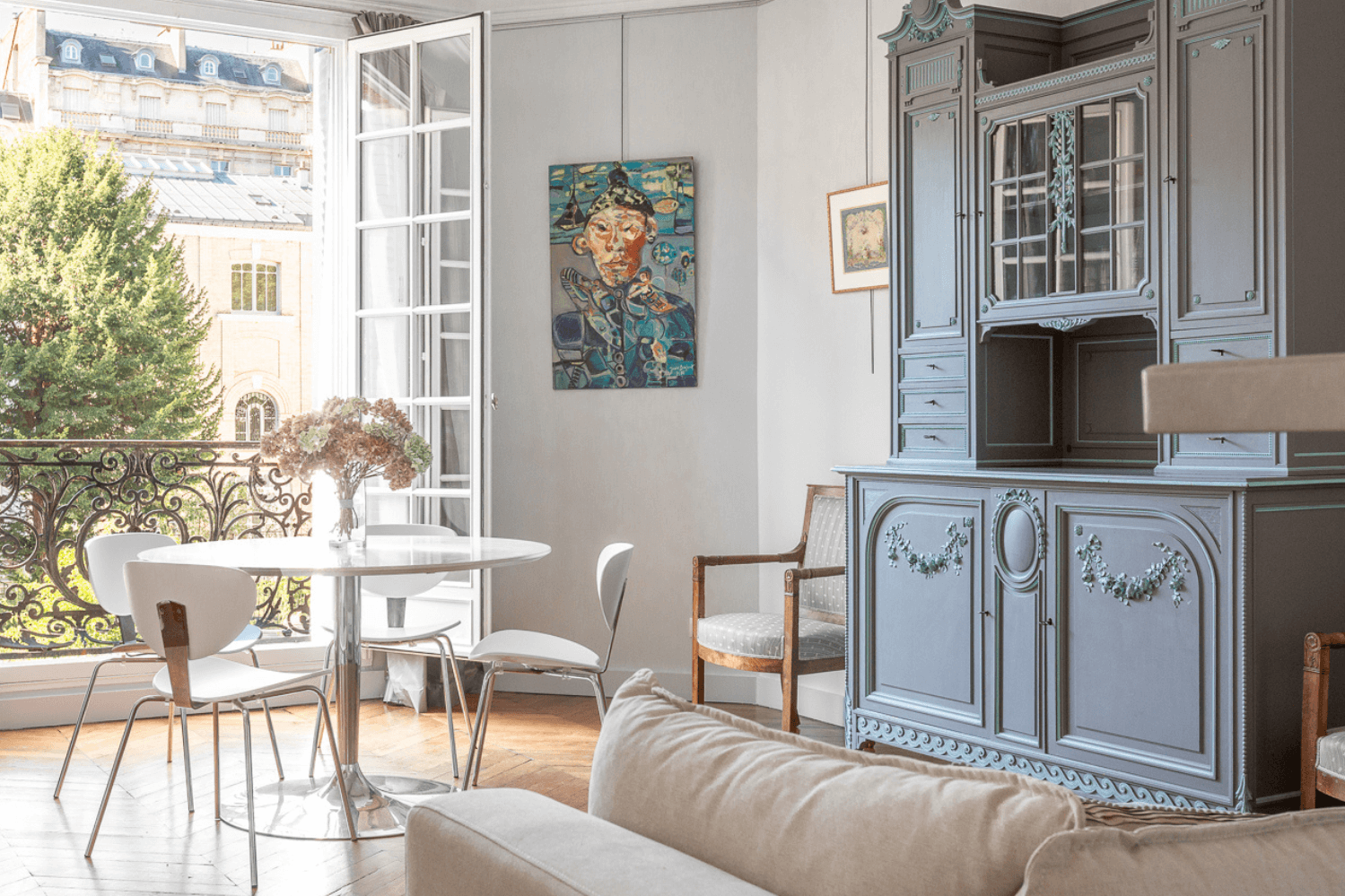

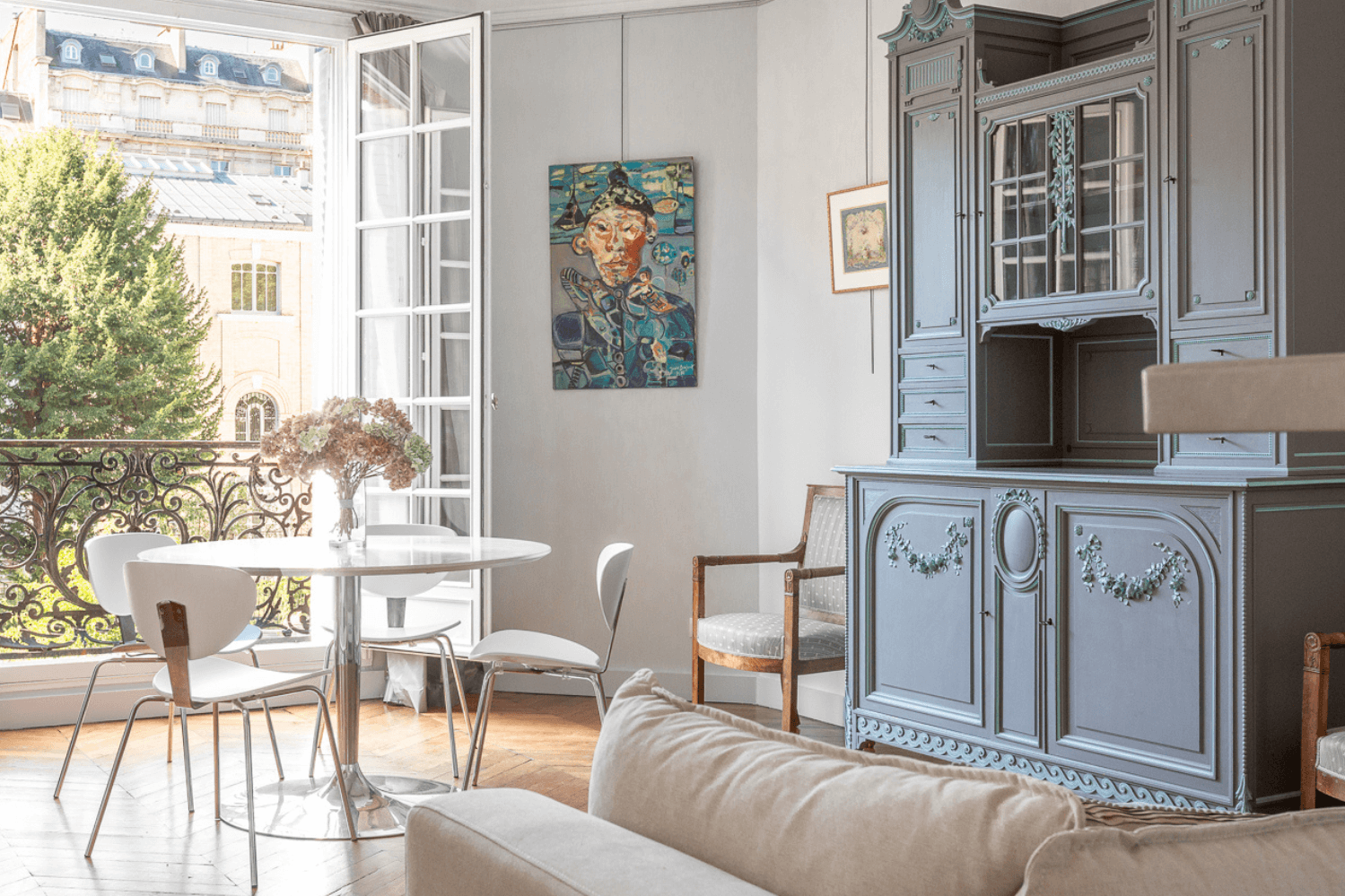

Paris is renowned for its enchanting architecture, rich history, and vibrant culture, attracting around 50 million visitors yearly. This makes it a prime location for rental investment. With changing tax policies, rental regulations, and market conditions, property owners face critical decisions when choosing between long-term and short-term rentals to maximize their investment. This blog will outline the key differences between the two options, highlighting the advantages and disadvantages for landlords.

Advantages and Disadvantages of Long-Term Rentals

Long-term rentals usually accommodate tenants who move into the property as their primary residence. However, secondary residence corporate housing rentals can also be long-term, depending on the residency time.

A long-term lease typically lasts one year or more for furnished rentals and three years for unfurnished accommodations.

What Are the Advantages of Long-Term Rental?

Stable Source of Income

One of the primary advantages of long-term rental is stability. Landlords can count on a steady income for one year or more without the constant turnover of tenants. The rental revenue is especially promising in big cities; for example, in Paris, depending on the neighborhood, the average monthly rent for a one-bedroom apartment in the city center is around €1,300 to €2,000, €2,200 to €3,500 for a 2-bedroom apartment,€3,500 to €5,500 for a 3-bedroom apartment and even higher for bigger surface or luxurious amenities.

Lower Maintenance Costs

In long-term rentals, tenants typically stay for at least one year in furnished apartments and three years in unfurnished ones. This extended occupancy significantly reduces maintenance costs for property owners compared to short-term rentals. For example, hiring a cleaning crew is less frequent, as cleaning is generally done only at the beginning and end of a long-term lease. Besides, for long-term rentals, owners may charge tenants for cleaning costs depending on the state of the apartment at check-out.

Usually, long-term tenants treat the property responsibly and carefully, yet wear and tear takes its toll; however, natural wear and tear does not call for repair from tenants. During the tenancy, residents are responsible for minor maintenance, like changing light bulbs and replacing seals for plumbing, which helps manage maintenance costs effectively.

Additionally, owners share a portion of condominium charges (charges locatives) with tenants, further distributing maintenance costs.

Fewer Tax Charges

By choosing long-term or short-term rentals, landlords are responsible for Property tax.

The housing tax is not due on a primary residence. However, tenants who rent a second or corporate home pay the housing tax. In both cases, the owner avoids the vacant home tax as the property is occupied for an extended period.

The waste collection tax is the tenant's responsibility, whether in a long-term or short-term rental arrangement, unless the rent includes all charges.

Inconveniences of Long-Term Rentals

Lack of Flexibility

Long-term rentals as a primary residence offer less flexibility for property owners, particularly if they wish to reclaim their property. Landlords cannot regain possession unless they go through specific legal procedures. For instance, the owner must provide advance notice—typically three months for furnished properties and six months for unfurnished ones—before terminating the lease for reasons such as personal use, resale, or a severe and legitimate reason.

Besides, property owners do not have legal access to the rented property. Owners cannot visit the tenant unannounced as they must respect the tenant's privacy, or use the property in their absence without permission. The owner risks a one-year prison sentence or a fine of €15,000 if they access the property without the tenant's consent.

Restricted rent price

In France, long-term rentals are subject to strict regulations, especially in high-demand areas.

In high-demand zones (known as "zones tendues"), rent control restricts landlords’ rent amount they can charge, capping their potential income on property type (furnished or unfurnished), number of rooms, building's construction period, and location.

For instance, under Paris's rent control regulations, the maximum rent for furnished apartments in the northern part of the 16th district (including Victor Hugo, Trocadéro, and Passy - La Muette) is €40.30 per square meter for studios, €36.30 for one-bedroom apartments, €34.80 for two-bedroom apartments, and €34.40 for three or more bedrooms.

Concerns About Rent Arrears

In France, tenants benefit from solid legal protections, making eviction and unpaid rent recovery challenging and time-consuming. Landlords risk facing unpaid rent, which can lead to financial and mental stress, notably during the suspension of tenant evictions for the winter period ("trêve hivernale" ), typically from November 1 to March 31. To mitigate these risks, landlords may need to invest in rent guarantee insurance, which can add to their expenses, with premiums ranging from 2% to 5% of the annual rent.

Advantages and Disadvantages of Short-Term Rentals

Renting out a property for a short duration generally involves seasonal rentals (location saisonnière), which can extend up to 90 consecutive days for the same tenant. These rentals mainly cater to tourists and business travelers. If the property is the owner's primary residence, they can rent it for 120 days per year, maximum.

What Are the Advantages of Short-Term Rental?

Higher Rental Yields

Short-term rentals offer a better rental yield (8 to 10 %) than long-term leases (3 to 6 %), as they are not subject to rent control regulations, even in high-demand areas. Landlords can set their rental prices without limitations. In central districts in Paris, nightly rates can range from €100 to €300 for 1-bedroom accommodation, depending on the season and amenities offered. This flexibility allows property owners to capitalize on peak tourist seasons in Paris, such as Christmas, Summer, Fashion Week, and Nuit Blanche, potentially leading to greater profitability.

Greater Flexibility

This type of rental can be an excellent choice if you want the flexibility to use the property occasionally throughout the year as a second home or vacation getaway for a few weeks each year while renting it out during other times.

Additionally, if the owner encounters an unexpected event and wishes to reclaim the property for personal use—whether for themselves, family, or friends—they can easily do so. Moreover, this option allows them to convert the property to a long-term rental, sell it, or undertake renovation without the lengthy process typically associated with long-term leases.

Less Rental Risks

With short-term rentals, tenants typically stay for a shorter period, requesting professionals to clean and maintain the property before new guests arrive, which is frequent. This regular turnover gives the owner consistent property oversight, enabling them to address any minor repairs or improvements quickly.

Additionally, tenants usually pay for their stay upfront, often online. This upfront payment minimizes the risk of unpaid rent, a common concern with long-term leases.

Disadvantages of Short-Term Rentals

Less Stable Seasonal Rental Income

Short-term rentals experience high and low seasons. Demand can be very high during peak season, leading to maximum occupancy and income. However, in the off-season, property owners may face a significant drop in their rental income.

Higher Marketing Costs

Short-term rentals require constant visibility to attract new tenants, resulting in higher marketing and communication expenses than long-term rentals. For example, most owners of short-term rentals rely on platforms like Airbnb, Booking.com, and Abritel, which charge owners commission fees of around 18.5% of the reservation base. On the contrary, the agency commission fee for owners for long-term rentals is relatively lower, ranging from around 500€ for a Code Civil lease to one month's rent for a primary residence lease.

Intensive Property Management

Short-term rentals have a high turnover rate. While it can reduce the potential risk of property damage, owners must incur more significant management costs to ensure the property is in perfect condition between each tenant. These costs include cleaning (ranging from €50 to €150 per session), restocking supplies (such as toiletries, kitchen essentials, linens, and towels), and pest control. Also, increased wear and tear on furniture, fixtures, and appliances can lead to higher repair costs in time.

New Tax Regulations: Less Favorable Conditions for Short-Term Furnished Rentals

To limit the number of furnished tourist rentals in France, the French government is implementing stricter regulations, including:

New Bill to Control Short-Term Rentals in France

The Barnier government has revived a "transpartisan" bill aimed at better regulating tourist rentals in France. This bill seeks to control the unchecked growth of short-term rentals.

Mandatory Declaration in 2025

In 2025, all short-term rentals will require a mandatory online Declaration to be submitted to a French national teleservice.

Mandatory Proof of Principal Residence

Suppose a landlord wants to temporarily rent out their primary residence for a short-term rental. In that case, they must provide proof, such as their tax notice showing the rental property address as their primary tax address, to ensure there are no misleading claims such as false primary residence declaration.

Fire Safety Compliance

Owners renting secondary residences to tourists must prove compliance with fire safety regulations.

Energy Efficiency Requirements for Short-Term Rentals

In 2025, the law will ban properties rated F or G for energy efficiency from renting as short-term rentals. All new tourist rentals must be at least rated E by the DPE.

Additionally, the owners may be required to provide Energy Performance Certificates (DPE) to show that the rental property is energy-efficient.

Increased Tax Scrutiny

The fiscal landscape for short-term rentals is under scrutiny. New proposals potentially reduce tax allowances and change how rental income is taxed, discouraging short-term rentals in favor of annual leases. The French Council of State has canceled the tax break for short-term furnished rentals. Until then, renting a short-term furnished apartment or a "gite" could benefit from a tax reduction of 71%, or even 92% in some cases.

The tax reduction on furnished tourist rentals is now 30% or 50%, depending on whether the apartment is 'classified' or 'non-classified.'

Transparency in Co-Ownership

From 2025, co-owners must notify when they rent their apartments to tourists, fostering transparency and reducing conflicts between residential and tourist uses.

Do not worry; the new tax regulations on furnished accommodation for tourists do not affect landlords of furnished properties rented on a long-term basis.

How to Choose the Best Option for Your Real Estate Project

Deciding between long-term and short-term rentals hinges on your financial situation and investment goals.

Long-term rentals might be better if you value a stable income and minimal management responsibilities and are comfortable with a certain level of inflexibility and reduced control. On the other hand, short-term rentals could be more lucrative if you're looking for higher income and can commit time and money to manage your property actively.

The Role of Paris Rental in Managing Long-Term Rentals

At Paris Rental, we specialize in Long-Term Rentals. We help property owners find reliable tenants (companies, diplomats, ex-pats) while handling all administrative aspects of leasing. Our multilingual team offers comprehensive services, from tenant screenings to lease negotiations, ensuring a smooth and hassle-free rental experience. With 37 years of expertise, Paris Rental can maximize your property’s potential for long-term rentals.

Editor: Siyi CHEN

Français

Français